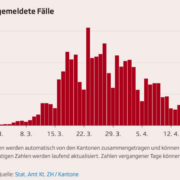

Safe and Snug in My Remote Office, Or Am I?

/0 Comments/in Blog, Tech & Society/by HGSSS ADMINMarch 2020 was scary for most people around the world. A new and dangerous virus was afoot and uncertainty was the order of the day. As it turned out, for many of us we made a rapid pivot to working remotely and to social distancing.

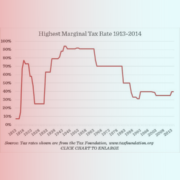

Tax and spend, crony capitalism and the peasant revolt

/0 Comments/in Blog/by HGSSS ADMINLet’s veer into the political economy today, a sort of third rail of market and economic commentary. The reason I want to discuss it is the tax grab contemplated by the Biden Administration in the US.

What an AI Laundry Machine Taught Me About Economics

/1 Comment/in Blog, Tech & Society/by HGSSS ADMINWe arrived in Japan recently to attend to some family matters. One household issue we also wanted to deal with was our legacy washing machine. Little did I know that this would start an adventure in both technology and Economics.

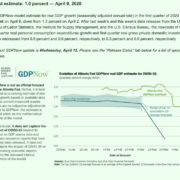

We need to adapt past experience to the present situation

/0 Comments/in Blog, What's New In Economics/by HGSSS ADMINNYC Office

Henry George School of Social Science

149 East 38th St., New York, NY 10016

Phone: (212) 889-8020

Fax: (212) 367-0940

Email: info@hgsss.org

Office Hours: 9:00 AM - 5:00 PM ET

Contact Us

Code of Conduct

149 East 38th St., New York, NY 10016

Phone: (212) 889-8020

Fax: (212) 367-0940

Email: info@hgsss.org

Office Hours: 9:00 AM - 5:00 PM ET

Contact Us

Code of Conduct

Notice of Non-Discrimination Policy

The Henry George School of Social Science admits students of any race, color, national or ethnic origin, age, gender or sexual orientation. The programs and activities of the School are available to all students on an equal basis.

The Henry George School of Social Science admits students of any race, color, national or ethnic origin, age, gender or sexual orientation. The programs and activities of the School are available to all students on an equal basis.