South Africa: Land of Hope and Many Sins

“Overcoming poverty is not a gesture of charity. It is an act of justice. It is the protection of a fundamental human right, the right to dignity and a decent life. While poverty persists, there is no true freedom.”

– Nelson Mandela during a 2005 speech on global poverty at London’s TrafalgarSquare

The Republic of South Africa (RSA) is a study in contrasts. It’s a history of colonialism, post-colonialism, then national liberation for all…a fast-paced evolution from around 1910 (when the Brits pulled out) until today. The rapid changes in politics and the very structure of society are watched with trepidation by South Africa’s neighbors and its citizens. Trading the Boers for the ANC-dominated democratic system perpetuated, in a sense, the gulf between the haves and the have-nots. Political liberation must involve all citizens, but so must economic freedom. The RSA’s neighbors provide two comparisons. We leave it up to the reader to decide which is best: Namibia or Zimbabwe?

Many destructive factors in the neoliberal world order have a home in the RSA. Rent-seeking is alive and well. Government favors a select few burdens both people and the economy with Monopoly privilege. Many are classic examples: monopolies in power production and delivery, transportation, banking, and the mobile phone industry. Rent-seeking is a natural result as friends, family, and other interested parties get access to utilities, corporations, and government contracts.

The domination by the Afrikaner tribe imposed a rigid racial and economic system. Slowly, they are fading into the judgment of history. But the havoc they wrought is lingering. It’s fair to say that the new ANC system is as self-interested as the Boers were. In fact, the 1994 post-apartheid environment soon adopted the chummy methods of the 1910s to 1991 Afrikaner governments.

When Nelson Mandela became president of the country, he brought some patently ineffective attempts to nationalize vital industries. Still, he encouraged free markets to help eradicate poverty. That can work for a while, like Britain after 1945, but moving ANC loyalists into positions of control, including utility, petrochemical, and steel industries had a chilling effect on investment, exacerbating existing shortcomings in those sectors.

Rolling blackouts have been a disaster for the people. All the RSA’s big-ticket industries are gasping for electricity with no end in sight. In the free-for-all, when Jacob Zuma ascended to the presidency, mismanagement, forgone maintenance, and corruption were baked into the system. There is even an exquisite phrase for what’s happened in crucial sectors: “state capture” or, in other words, rent-seeking on steroids. One plunge into the investigation will leave you looking for a hot shower.

Honesty in Government: The Last Best Hope?

We do have examples of systems and governments recovering from graft, including places where one might suspect rooting out corruption isn’t high on the “to-do” list, such as Ukraine.

An independent judiciary acting as a separate branch of government is one crucial step. Anecdotally, things are improving but the ANC party connection still has its thumbs on the scale. Nevertheless, president Cyril Ramaphosa is cautiously well-respected and by several degrees has a less compromised administration than former Pres. Jacob Zuma.

South Africa’s taxes: kind of a mess.

At the start of the post-apartheid era, South Africa’s tax and revenue agencies were overhauled from the national party days by cleaning out the stables. The South Africa Revenue Service was lauded for its efficiency and transparency. But, after Pres. Mandela’s terms expired, successor administrations hopped on board the gravy train, with interference by close associates of national leaders. Revenue collection which had been increasing, started to wane. The income tax in the lower brackets was very high. Like other former colonies of the UK, Stamp Duty Land Tax (known as real estate transfer tax in the US) is levied on all property transactions above $114,000 in value. Stamp duty is notorious for nudging real estate prices from the realm of the affordable into exclusionary.

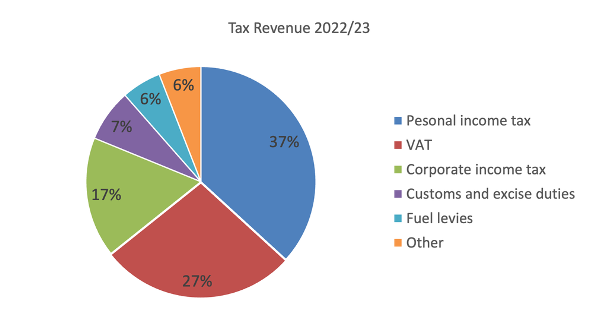

Also troubling is the reliance on flat, regressive taxes like VAT and fuel tax, both regressive taxes.

Happily, the national government is starting to ratchet down personal income taxes and this year is targeting value-added tax.

The mother of all monopolies

It may not be cricket to use a Churchill phrase, but the control of land (and crucially not just rural/agricultural land) is at the heart of South Africa’s long struggle. In fact, if Nelson Mandela had been an actual communist, land reform would have been bloody and disastrous.

There is a chance for a bloody dénouement as the pace of land transfers and compensation has always been glacial. Offshoots of the ANC have called for full seizure/nationalization of land. Indeed, an offshoot faction of the ANC, the Economic Freedom Fighters, has made its reputation for demanding quick “by any means necessary” repatriation of land to black Africans. It’s firebrand leader Julius Malema continually gains support from the electorate with his outspoken views on land and disappointment with the ANC. His call for restorative justice makes hearts leap, but one look at Zimbabwe’s experience confirms that may not be the way to go. Of course, Henry George School members know that Namibia’s alternative approach attained the desired goals but without shooting. Namibia’s land value tax directly funds repatriation of land to the original small holding farmers with technical and equipment assistance.

The Taxation of South Africa’s Urban Land Value: A Lost Art

There’s one facet of the South African story that deserves attention: past use of land value taxation to propel development in urban areas. Nothing can excuse or gloss over apartheid. Actually , LVT can only work better in a more just society. Those parts of society that need a hand without market distorting taxes must have a share of the “common wealth.”

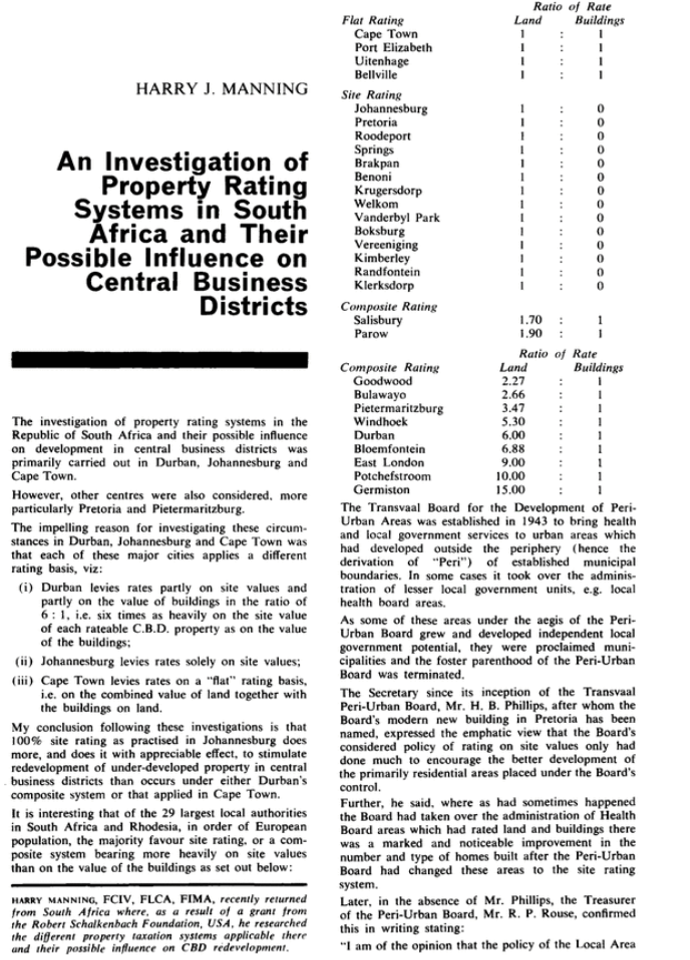

But the bottom dropped out in 2004 when the national government abolished local choice for taxation. Previously, most successful cities in the RSA had LVT (or site value rating). Being tied to the apartheid regime, LVT was an easy target in the eyes of Marxist apparatchiks. The largest city (Johannesburg) would not be naturally considered a terrific location with very little water and on a hill. But 80 years of SVT helped turn the city into success story. Johannesburg’s infrastructure was highly lauded when SVT was inaugurated.

Deep research into the history and effects of land value tax in Johannesburg demonstrated the power of a well-designed tax system. For nearly 100 years, value-added also meant value captured. Enthusiastic and policy voices still call for the return of a tax policy based on logic and justice.

Leave a Reply

Want to join the discussion?Feel free to contribute!