SCOTT BAKER

- Have Conditions in the Laboring Class improved from Henry George’s Time to our Own?

- The Land Cycle and the Stock Market

- Discussing the views of Piketty on inequality, with an eye towards Henry George

- The Real Lessons in Greek for Leftists

- A Rebuttal to Doom-and-Gloom forecasts such as Debt Collapse: The Decline and Fall of the USA

- China shifts taxes to Land

- Land Worth = GDP and enough to replace all taxes with Land Rent

- America Is Not Broke, Revisited

- The Simple Healthcare Plan for all that Ought to Please Everyone

July 29, 2014

By Scott Baker

Labor conditions were indeed often appalling in the nineteenth century, but are they any better now? Let’s start with a specific example and broaden our findings from there. A comparison of Labor’s life from a hundred years ago to today. Have things improved…or been offshored?

Henry George defined Labor as simply all mental and physical effort used in production. And, in George’s political economy, production is defined as all the processes involved in making wealth and bringing it from its place of origin to the consumer. It should go without saying that the only production that counts is that which satisfies consumer. As a counter-example, I may expend hours of labor whittling away a wooden toy car, but if there is no consumer willing to pay me for it, my labor is said to have no economic value.

So, let us confine ourselves to labor that has clear economic value when comparing conditions of Labor in Henry George’s time to our own.

Labor conditions were indeed often appalling in the nineteenth century, but are they any better now? Let’s start with a specific example and broaden our findings from there.

In “Social Problems,” George talks about tailors in New York City who are able to find employment only part of the year and have to “beg, steal or starve” the rest[1], or rely on a “charitable society.” Certainly, the tailors of today, unless they out and out fail in business, and probably not even then, do not alternate between being profitably employed and begging, stealing or starving, so this is progress, right? But, wait a minute. In addition to mending my clothes, my neighborhood tailor also dry cleans them in fact, dry cleaning is now such a large part of their business that they are known chiefly by that title: Dry Cleaner, and tailoring is only a secondary line of work for them. In our modern society, we outsource our clothes-cleaning (now both more frequent and more complicated than in George’s day of simpler garments), and occasional mending. This at least provides consistent employment for tailors, and a wider range of skill development (I don’t know how to use Dry Cleaning chemicals to clean my clothes, do you?). So, onward and upward! As his customers benefit, so does the tailor”or does he?

There is something the tailor is definitely not doing much of these days, unless he is very skilled and his customer very rich, and choosy, and that is making clothes out of whole cloth. Here is a list of Tailor-related jobs from the 1891 London Census:[2]

Tailor

Someone who made or repaired clothes

Tailor & Clothier

Someone who made or repaired clothes.

Tailor Coat Hand

A tailor’s assistant.

Tailor Hand

A tailor’s assistant

Tailoress

A female tailor

Tailor’s Apprentice

Someone learning the tailor’s trade

Tailor’s Assistant

A tailor’s assistant

Tailor’s Cutter

A tailor’s assistant – cuts cloth

Tailor’s Labourer

A tailor’s assistant

Tailor’s Machiner

A tailor’s assistant – machines cloth

Tailor’s Machinist

A tailor’s assistant – machines cloth

Tailor’s Presser

A tailor’s assistant – presses cloth

There were fully a dozen jobs just in the lowly Tailor’s shop in the nineteenth century. Today’s tailors exist mostly with one or two assistants and delivery people, or work for a large clothing store where there is enough volume.

So, one must be careful to compare apples to apples and tailors of old to persons sometimes split across multiple professions – who perform the same function today, whatever their titles. One thing that is clear is that we still need the products of those who labor to make clothing indeed, our closets bulge with a quantity of garments that most people in George’s day would not own in a lifetime. Whether we need so many items is for discussion outside this paper, though George did warn us that human desire is basically insatiable.

Perhaps our labor has become so efficient that machines do all the drudgery for us?

Three decades ago, I tagged along with a group of fashion students on a tour of the Jantzen Sportswear Company in Portland, Oregon (as a young man, I was curious about everything). There were machines to do all kinds of things, from spinning the cloth in so many vibrant colors! to cutting the cloth so efficiently! to producing the final garments in seemingly unlimited quantities, cheaply and powerfully. This indeed seemed to be the future of modern clothes-making. Yet, we are told in the late 1990s that:[3]

Today, Jantzen is the leading brand of swimwear in over 100 countries, although a tough business climate forced the company to lay off workers, move some production operations to Latin America and the Caribbean, and discontinue its sportswear lines (emphasis added).

The business decisions of a particular manufacturer are beyond the scope of this paper, but anyone who is even slightly aware of what’s been going on since George’s time, will understand that manufacturing as a whole has moved to the lowest margin of production that is, to the place where it is cheapest to produce the goods that will satisfy human desire. So, it is not accurate to say today’s American tailor is better off than yesterday’s he simply has a different job description. But what about that jettisoned function making clothes? What was life really like for people who actually made clothes, in large amounts, in George’s day? I’ll use an example from the turn of the twentieth century, slightly after George’s time, for reasons that will become clear later the Triangle Shirtwaist Factory.

The Triangle Shirtwaist Factory took up the eighth, ninth, and tenth floors of the Asch Building. Under the ownership of Max Blanck and Isaac Harris, the factory produced women’s blouses (known at the time as “shirtwaists”). The factory normally employed about 500 workers, mostly young immigrant women, who normally worked nine hours a day on weekdays plus seven hours a day on Saturdays. [4]

Says Pauline Newman, who actually worked at the factory:[5]

In the first place, it was probably the largest shirtwaist factory in the city of New York.

My own wages when I got to the Triangle Shirtwaist Company was a dollar and a half a week. And by the time I left during the shirtwaist workers strike in 1909 I had worked myself up to six dollars.

But you see hours didn’t change. The hours remained, no matter how much you got. The operators, their average wage, as I recall”averaged around six, seven dollars a week. If you were very fast – because they worked piece work” and nothing happened to your machine, no breakage or anything, you could make around ten dollars a week.

They were the kind of employers who didn’t recognize anyone working for them as a human being. You were not allowed to sing. Operators would like to have sung, because they, too, had the same thing to do, and weren’t allowed to sing. You were not allowed to talk to each other. Oh, no! They would sneak up behind you, and if you were found talking to your next colleague you were admonished. If you’d keep on, you’d be fired. If you went to the toilet, and you were there more than the forelady or foreman thought you should be, you were threatened to be laid off for a half a day, and sent home, and that meant, of course, no pay, you know?

Unfortunately, as most New Yorkers with a smattering of history know, the worst was yet to come.[6]

The Triangle Shirtwaist Factory Fire in New York City on March 25, 1911, was one of the largest industrial disasters in the history of the city of New York, causing the death of 146 garment workers, almost all of them women, who either died from the fire or jumped from the fatal height. It was the worst workplace disaster in New York City until September 11, 2001. Most women could not escape the burning building because the managers would lock the doors to the stairwells and exits to keep the workers from taking cigarette breaks outdoors during their shifts. Women jumped from the ninth and tenth stories as the ladders on the fire trucks could not reach these. The fire led to legislation requiring improved factory safety standards and helped spur the growth of the International Ladies’ Garment Workers’ Union, which fought for better and safer working conditions for sweatshop workers in that industry.

So, this tragedy national in significance led to improved worker conditions and unions to ensure workers’ rights. If that was the end of the story of where clothing comes from, and if it was merely a dramatic example of a general trend towards better labor conditions overall in all industries over time, than the “iron law of wages” which determines wages to the minimum on which laborers will consent to live and reproduce”[7] would seem to be wrong. But, of course, as George points out, the true cause of the global minimum wage is “an inevitable result of making the land from which all must live the exclusive property of some.”[8] Since this arrangement has not changed since George’s time, neither has the result. Here is how things work in today’s globalized market:

In a recent examination of “Patriotic clothing,” WCCO-TV went to Minnesota’s Mall of America (and found) every item with an American flag on it was made in China. At other stores with patriotic apparel, labels read made in China, El Salvador, Guatemala, Honduras and Russia.

At Target, WCCO-TV found more than 80 pieces of patriotic clothing. Of all the items, only one T-shirt was made in the United States. At Old Navy, WCCO-TV could not find any American-made patriotic apparel. At Wal-Mart, more than 40 patriotic items were checked. Most were made in America, which is no accident. Wal-Mart has a policy where any item with an American flag on it must be made in the USA.

Ninety-seven percent of all clothing sold in the United States is no longer made in the U.S. Yet, Minnesota is home to two long-standing textile manufacturers.[9]

We’ll look to the direct source of that claim that 97% of clothing no longer made in the United States in a moment, but first let’s look at a modern-day shirt factory right here in Manhattan. In the year 2000, reporter Henry Blodget found:

behind grimy windows, Chinese women slaved for 11 hours a day, stitching garments for a subcontractor hired by Donna Karan International. The women received no bathroom breaks, no overtime pay, no sick days, no paid vacation, and no maternity leave. They were screamed at to “work faster” and paid “per piece”–earning wages

that could only be called “living” if “living” means boiled water and rice” the miserable workers weren’t migrant Chinese peasants but immigrant Chinese and Latina women.[10]

Blodget tells us that this factory, so reminiscent of the Triangle Shirtwaist Factory a hundred years before it, has now been supplanted by travel bureaus and financial companies, but surely this cannot be the last one, either in New York City, or in the more invisible nether regions of America.

In fact, our own U.S. Department of Labor tells us that:

50% of garment factories in the U.S. violate two or more basic labor laws, establishing them as sweatshops. Sweatshops exist wherever there is an opportunity to exploit workers who lack the knowledge and resources to stand up for themselves. Typical sweatshop employees, ninety percent of whom are women, are young and uneducated. Many of them are recent or undocumented immigrants who are unaware of their legal rights. Young women throughout the world are subject to horrible working conditions and innumerable injustices because corporations, many of which are U.S.-owned, can get away with it.”[11]

One thing is clear, as George told us long ago:

And so, whatever be the character of the improvement (of machinery), its benefit, land being monopolized, must ultimately go to the owners of land.[12]

New Yorkers, of course, long ago mostly stopped working on actual land, so the owners are those who own the land where their factories reside, and pay so little for the privilege, that they can exploit garment workers at subsistence wages, or less, even here, in one of the most expensive cities in the world.

When even these owners finally cannot make a profit having factories in New York, they, or their competitors, find new land abroad, displace the peasants from that, and send them to work in new factories in distant lands where the sight of suffering workers, or workers leaping to their deaths from fires, will not upset squeamish Americans.

Women, in particular, are subject to grueling labor conditions, often enticed with false promises to leave their home countries, only to have their passports and money confiscated when they arrive in Southeast Asian or Middle Eastern countries. They are subject to sexual and physical abuse, being bought and sold like slaves, and incarceration. Often, their wages are under a dollar a day.[13]

It gets still worse.

In Myanmar – formerly known as Burma – villagers can be rounded up at anytime, forced to work on roads, pipelines, or whatever else the military Junta deems necessary to satisfy its customers including China, where it is not presenting a humanistic face for the West. People who refuse are beaten, often to death, imprisoned, and tortured.[14]

In this country, we do not call this Labor, we call it Slavery, for that is what it is. George, who saw American chattel slavery ended in his lifetime, would have recognized this form of slavery instantly. It is also beyond the scope of this paper to prove this, but it is my feeling that conditions of enforced labor have reached a level of depravity and abuse even worse than in George’s time. The ferocious hunger for the world’s diminishing resources, combined with the ready supply of people considered disposable by dictatorships in favour of resources throughout history has made vicious brutality a business practice in parts of the world Americans would prefer not to imagine, even if they could.

One cannot consider the condition of labor without considering the value of the Land they labor upon, as George stressed relentlessly from Progress and Poverty forwards. In fact, he makes the point that a laborer cut off from the fruits of Land is actually worse off than a slave:

So long as a plump, well-kept, hearty negro was worth $1000, no slave-owner, selfish or cold-blooded as he might be, would keep his negroes as great classes of “free-born Englishmen” must live. But these white slaves have no money value. It is not the labor, it is the land that commands value” (emphasis added).[15]

Elsewhere, a contemporary of Henry George, and former slave-owner, laughingly told him it was cheaper just to pay low wages for menial work to be done than to have to house and feed his former slaves. He went on to say that, had he known how much he would have saved by not having to house and feed his former slaves, in exchange for paying them a mere pittance to labor for him, he would have been in favor of abolition a long time before it finally came. How true is this labor equation in many parts of the world, still.

It is worth noting in this regard that it is the resource-rich regions, not the resource-poor ones, where labor conditions are the most appalling. In fact, we can narrow George’s strong implication into an axiom: Wherever the relationship between Land and the human labor to develop that Land is the least, the degree of human suffering will be the greatest.

Myanmar, for example, has the following resource wealth:

Copper, gypsum, barite, and cement. Steel and iron make up 6% of the country’s exports. Myanmar is second in opium production only to another bastion of horrid labor conditions, Afghanistan. Despite an import ban, one can regularly find Burmese Teak in the United States. Myanmar also has rubies, jade, pearls and fish which it exports to the Middle East and Asia, while a third of its own children are malnourished. Natural Gas accounts for 40% of Myanmar’s exports, flowing to China – and to Chevron.[16]

Myanmar is resource-wealthy, but its people are impoverished. In fact, when one reads of the atrocious working conditions in Myanmar, one longs for the relative comfort of resource-poor nations that only have sweatshops! At least there, the middlemen sweatshop managers, and factory-owners, act as buffers between the rapacious landowners and laborers.

What has happened to the dream of ever-increasing prosperity for all since George’s time? Didn’t the neoclassical Chicago School economists and the Free Market economists tell us that as bad as things may seem, that wealth would trickle-down eventually from the top income earners to the bottom, as they developed new businesses? Wasn’t it supposed to be that, as Julian Simon famously said in 1997:

The material conditions of life will continue to get better for most people, in most countries, most of the time, indefinitely. Within a century or two, all nations and most of humanity will be at or above today’s Western living standards.[17]

Indeed, Business Week warned us in a 2006 article on Chinese Factory Workers, that:

companies across the board are feeling the squeeze. Last year turnover at multinationals in China averaged 14%, up from 11.3% in 2004 and 8.3% in 2001. Salaries jumped by 8.4%, according to human resources consultant Hewitt Associates LLC.[18]

So, maybe it is onward and upward for everyone after all…eventually. All we have to do is run out of dark corners where people can be creatively exploited and then, finally, conditions will improve for those who labor so that, so we are told, we can live in relative splendor, here in the developed countries.

China may indeed, be coming around to recognizing Workers’ Rights, although Venture Outsource which bills itself as “an Authoritative Source for Decision-Makers” (Read: CEOs of multinational companies) – tells us Chinese labor rates for manufacturing are still below a dollar an hour[19] – this in a country that ranks fifth in the number of millionaires, as of 2007.[20] China’s Labor Bureau, optimistically, recommends setting the “minimum wage at about 40 to 60 percent of average monthly wages”[21] but this recommendation is regularly flouted, and perhaps most rigorously enforced only where high-profile factories producing goods for American manufacturers are concerned. In the more remote provinces, just as in the more remote regions of the U.S., people, often children, regularly work at or well below the minimum wage. In the countries that China itself outsources to the fourth world conditions are even worse, as previously described. Instead of free markets providing better lives for “most people, in most countries, most of the time,” an increasing number of regions, and even countries, has instead provided more ways to exploit the people within them.

Even where our better-known American brands are concerned, like Apple, conditions in China can easily fall behind the standards of the client company:

In its (own) report, Apple revealed the sweatshop conditions inside the factories it uses. Apple admitted that at least 55 of the 102 factories that produce its goods were ignoring Apple’s rule that staff cannot work more than 60 hours a week”these guidelines are already in breach of China’s widely-ignored labour law, which sets out a maximum 49-hour week for workers.

Apple also said that one of its factories had repeatedly falsified its records in order to conceal the fact that it was using child labour and working its staff endlessly.[22]

Before we leave this depressing litany of abuse and human degradation, let us be clear, it is not a given that resource-rich countries must always exploit the people within them. Near war-torn Congo’s southern border, Botswana has used its mines, which are partially owned by the state, to fund infrastructure, education, and health care, as well as set aside a rainy-day fund of nearly $7 billion. But, Botswana has something essential Congo does not: a government known for being both functional and honest.[23]

One might add that Botswana has another thing that Congo and almost every other country doesn’t have: a recognition that the value of the Land belongs to all of its people equally.

There is still something else doesn’t seem quite right about Simon’s promise, aside from the fact it has become awfully stale in the hundred years or so since value-free economics pushed aside Georgism and the other classical economists.

Consider that the average American CEO’s pay rose nearly 300% from 1990-2005, while the average American production worker’s pay rose only 4.3%, both figures adjusted for inflation[24] [25] (though inflation has been considerably higher for the lower and middle classes than for the tax and land-advantaged upper classes). It seems those in the highest balloon rise the fastest. Yet, people are generally more in debt, the middle class feels more vulnerable, and, so we are repeatedly told, we cannot afford our profligate ways any longer! Finally, household debt has risen from under 25% of GDP in 1954 to 99% in 2008.[26] Does this seem “onward and upward’ to you?

We come full circle to George again. Without justice in the distribution of Land, unskilled labor will be forced to a subsistence level, or, in the case of the middle class, be forced to borrow ever more to support a debt-ridden lifestyle for themselves, while enhancing an ever-more opulent one for the rich and grasping. If the middle class ever gets to the point where they finally cannot afford the shirts on their backs, where their ability to purchase becomes more closely aligned with third world labor’s ability to earn, it will be the middle class that sees its lifestyle go down, not the Land-owning elite. Improvements, or “mechanization” will not change that. Efficiency measures won’t even dent it American workers are already among the most efficient workers in the world. Without redistribution of the value of Land to all, who are both equally entitled and equally responsible for its rise in value, those without Land will always be forced to compete near the bottom just to survive, while “improvements” will only guarantee an even more obscene level of living for those who own the resources and charge others rent upon it.

Man without Land cannot survive, no matter how vigorously he labors. This was true in George’s day. It is true today.

________________________________________

[1] Social Problems, Henry George, 1883, Pg. 68

[2] http://www.census1891.com/occupations-t.htm

[3] http://www.answers.com/topic/-268

[4] http://en.wikipedia.org/wiki/Triangle_Shirtwaist_Factory_fire#cite_note-drehle-1

[5] http://historymatters.gmu.edu/d/178/

[6] http://en.wikipedia.org/wiki/Triangle_Shirtwaist_Factory_fire#cite_note-drehle-1

[7] “Social Problems,” Henry George, 1883, pg. 146

[8] “Social Problems,” Henry George, 1883, pg. 146

[9] http://wcco.com/seenon/Made.in.America.2.347947.html

[10] http://www.slate.com/id/2113689/

[11] http://www.mtholyoke.edu/%7Enshah/fashioncrimes/Sweatshops.html

[12] “Social Problems,” Henry George, 1883, Pg. 145

[13] http://www.mtholyoke.edu/%7Enshah/fashioncrimes/Sweatshops.html

[14] Mother Jones, For Us, Surrender is Out of The Question, Mac McClelland, March/April 2010

[15] “Social Problems”, pg. 102, Henry George, 1883

[16] Mother Jones, For Us, Surrender is Out of The Question, Mac McClelland, March/April 2010

[17] http://en.wikipedia.org/wiki/Julian_Lincoln_Simon

[18] http://www.bloomberg.com/magazine/content/06_13/b3977049.html

[19] https://www.ventureoutsource.com/contract-manufacturing/trends-observations/2008/hourly-manufacturing-labor-rates-in-china

[20] http://www.bloomberg.com/bw/stories/2007-10-17/the-global-millionaire-boombusinessweek-business-news-stock-market-and-financial-advice

[21] http://www.china-labour.org.hk/en/node/100206

[22] http://www.telegraph.co.uk/technology/apple/7330986/Apple-admits-using-child-labour.html

[23] Mother Jones, Blood and Treasure, Adam Hochschild, pg. 60, March/April 2010

[24] http://money.cnn.com/2007/08/28/news/economy/ceo_pay_workers/index.htm

[25] http://www.faireconomy.org/news/ceo_pay_charts

[26] http://lacoctelera.com/gracias.html

July 28, 2013

By Scott Baker

A description of the 18.6 year land cycle and how it relates to the current stock market, and whether history will win over modern intervention.

::::::::

Worried Dollar by N.A.

This article from well-known stock market prognosticator Zerohedge caught my eye recently.

The charts show the scale of deep and prolonged Fed-led market manipulation and are consistent with other data I’ve been seeing since the Fed started its trillion dollar/year QE purchases. The thing is, the phoniness of the asset market bubble is well-known on the street, so there’s a question of how much difference a taper or some other gradual change will make, though the scare of about a month ago seems to indicate at least short-term corrections are likely, plus we are technically over-bought here and in the weak part of the year, historically. Zerohedge seems to acknowledge all this at the end too.

We’re in uncharted waters as far as the asset markets go, starting with the fact there has never before in history been two 50% crashes in the market – 2000-2003 & 2008-2009 – in the same decade (or 50% rises either). This kind of volatility is not only unhealthy in itself, but speaks of massive intervention of the unhealthy kind.

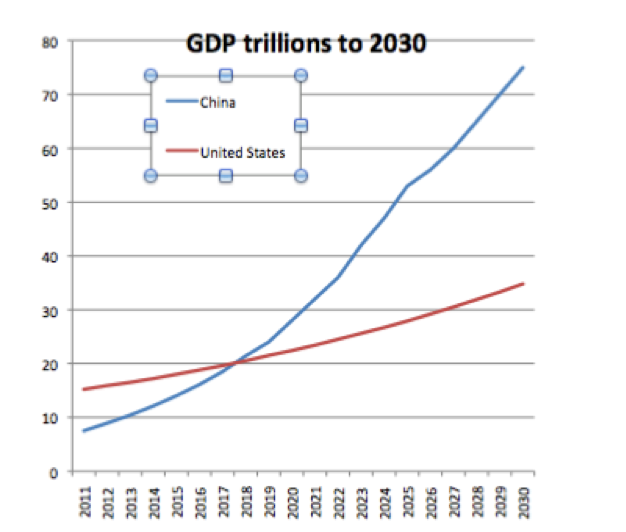

From the economic reformer perspective, both Georgist Fred Harrison and Georgist-Stock Market Guru Phil Anderson say we are at the beginning of the next 18-year land-based stock bubble, and like the beginning of all bubbles, it will be slow at first, followed by a mid-cycle correction (Harrison, in his new book, “The Traumatised (English spelling) Society” says this will come 2019, with a China-led global crash coming in 2028; Anderson recommends Harrison for his prescience in his newsletters). Harrison was correct in 1997, in predicting a 2010 housing market bottom (perhaps the bottom came a bit earlier than that, but few would have imagined the unprecedented Fed and Gov’t intervention in 2008-2009 too). Harrison was making his prediction back in the Dark (or light?) Ages before even the repeal of Glass-Steagall!

But, take a look at this chart of inflation-adjusted home prices according to the Case-Shiller index going back to 1890 (Henry George’s time!):

In 2006, just as the Housing market was peaking, the NYT ran this graphic of the 100-year Case Shiller chart. It showed how radically overvalued Housing had become.

Two years later, TBP reader Steve Barry updated that graphic, including the projected Home Price mean reversion. (See versions for 2008, 2009 and 2010).

Its time to update this for 2011. Note the 2009 tax credit wiggle:

Case-Shiller Index since 1890 by The New York Times

If the red line is followed – this chart stops in 2011 – we still have a long way to go to get to normal re-evaluation of house (read: land) prices…going down .

The Fed is trying to defy the natural law of supply/demand with lots of money from nothing (well, technically toxic assets, but these MBS are worth nothing like what is being paid for them – that’s what makes them “toxic”), but these are being turned into new speculations on land (Dr. Cay Hehner talked about this in the last Left Forum panel with Dr. Michael Hudson too; it was hedge funds and other speculators who started the post-crash land “boom” which still is invisible in this big picture chart, although that may be because it is not current enough). Still, is all this goosing enough to keep things above the Mean of 100? Is it even healthy for us to be above the Mean when the productive sector is money-starved?

Zerohedge, Phil Anderson, and other market followers would of course like things to go up, even while recognizing the phoniness of the Ponzi scheme, but this might be coloring their objective analysis. Clearly, a reversion to the mean would mean another 20-30% correction in housing, and most likely stocks, since they are so dominated by the FIRE sector now. At some point, the Fed – though most likely Bernanke’s successor (especially if it is hard-nosed, opinion-immune, Larry Summers) – will have to step off the gas, interest rates will rise, loans will be even further reduced, and the way financial institutions make most of their money – through Derivatives, Mergers and Acquisitions, and Wealth Management, won’t work anymore (JP Morgan invests 69% of its assets this way, leaving just 31% for traditional loans, typical of the TBTF banks – yet another argument for Public Banks).

Then comes the crash, but maybe bail-ins instead of a bailouts, now that that is prevented by Dodd-Frank (at least in theory, practice TBD). The joint FDIC-BOE plan, announced in a paper in December, to do a Cyprus-style involuntary bank deposit for bank equity swap, will trigger the Mother of All Bank Runs. Then the FEMA camps, draconian anti-liberty laws and practices without laws, as feared in the comments to this Zerohedge article, will really come out in force. As former president Jimmy Carter said in what must be the most mainstream media under-reported significant comment made by a living president of all time, “America no longer has a functioning democracy.”

I wonder if even the hundreds-years old 18.6 year land cycle can withstand that.

May 4, 2015

By Scott Baker

(Video included) I was asked to be a co-host for a Webinar discussion by president of the Henry George School of Social Sciences in New York City, Andrew Mazzone on April 22, 2015. We discussed the views of Thomas Piketty, Yanis Varoufakis and Henry George on the economic issues of today.

::::::::

The Webinar lasted 2 hours and can be seen here:

Mazzone had asked me to join him as a follow-up both to my appearance with him on the first of his increasingly popular Smart Talks with economists, in which we both interviewed Yanis Varoufakis when he was just a well-known economist in the Fall of 2013, and to his own later follow-up with Varoufakis on Piketty. You can see the first interview with all three of us here: From the Henry George School: Debating Economics And a sub-portion of the hour plus long video was highlighted when I wrote a follow-up after Varoufakis became Greek Finance Minister, wherein I had discussed with him the possibility of Greece issuing endogenous debt-free Sovereign Money, and then written a brief Mazzone/Baker plan for fixing Greece’s economy.

…….

…..

…..

The Mazzone/Baker Plan:

1. Issue drachmas for local consumption and spending. The amount should be enough to meet the 30% Output Gap, but not enough to cause too much inflation; the problem now, of course, is rampant deflation caused by too little money in circulation.

2. Agree to pay off the debt over 100 years, 1/100th per year. In reality, this will be the basis for negotiation, but it is a concrete one, something that has not been offered so far.

3. Use the devalued currency to encourage cheap tourism to Greece and exports. Tourism growth estimates vary considerably but 16.7% is a good mid-range calculation in 2014, and tourism remains Greece’s main economic engine, supporting 53 job categories.

4. Tax the large landowners with a Land Value Tax. It turns out that the Greek Orthodox Church is the country’s second largest land owner, after the government, but actually, this is imprecise, because in Greece, the church is part of the government, and its priests also collect a salary from government and the church owns stock in publicly traded companies like the Bank of Greece.

This article was put online at the school’s website a few weeks before the Webinar and future students were encouraged to read it and watch the embedded video snippet to understand some of the issues that might come up in the Webinar better. It was pre-Webinar homework. That article was originally published here: Will Greece or the EU Blink first?

As preparation for the Webinar I re-watched the follow-up interview Mazzone had with Varoufakis in which he discussed the recent economics best-seller from Dr. Thomas Piketty: “Capital in the 21 Century,” just before Varoufakis was appointed Greece’s Finance Minister. Though Varoufakis is probably, and understandably, too busy to have joined us for this Webinar on Thomas Piketty, Mazzone and I met to discuss his views, our own interpretation of Piketty’s important work, and also to put it in contrast to the solutions offered by Henry George, especially in his 1879 best-selling opus, Progress and Poverty (see video above), while interacting with the students. Mazzone’s second interview with Varoufakis, discussing Piketty, can be found on the school’s website, here: Smart Talk with Andrew Mazzone and Dr. Yanis Varoufakis.

Varoufakis also wrote a review in 2014 of Thomas Piketty’s book, in which he said:

The commercial and discursive triumph of Thomas Piketty’s Capital in the 21st Century symbolizes this turning point in the public’s mood both in the United States and in Europe. Capitalism is, suddenly, portrayed as the purveyor of intolerable inequality which destabilizes liberal democracy and, in the limit, begets chaos. Dissident economists, who spent long years arguing in isolation against the trickle-down fantasy, are naturally tempted to welcome Professor Piketty’s publishing phenomenon.

The sudden resurgence of the fundamental truth that the best predictor of socio-economic success is the success of one’s parents, in contrast to the inanities of human capital models, is undoubtedly uplifting. Similarly with the air of disillusionment with mainstream economics’ toleration of increasing inequality evident throughout Professor Piketty’s book. And yet, despite the soothing effect of Professor Piketty’s anti-inequality narrative, this paper will be arguing that Capital in the 21st Century constitutes a disservice to the cause of pragmatic egalitarianism.

Underpinning this controversial, and seemingly harsh, verdict, is the judgment that the book’s:

• Chief theoretical thesis requires several indefensible axioms to animate and mobilize three economic ‘laws’ of which the first is a tautology (SB – Piketty himself admits this in his early pages), the second is based on an heroic assumption, and the third is a triviality

• Economic method employs the logically incoherent tricks that have allowed mainstream economic theory to disguise grand theoretical failure as relevant, scientific modeling

• Vast data confuses rather than enlightens the reader, as a direct result of the poor theory underpinning its interpretation

• Policy recommendations soothe our ears but, in the end, empower those who are eager to impose policies that will further boost inequality

• Political philosophy invites a future retort from the neoliberal camp that will prove devastating to those who will allow themselves to be lured by this book’s arguments, philosophy and method.

Varoufakis’ complete 18-page paper, which has some moderately involved math regarding Piketty’s 3 main formulas, may be found here: http://www.paecon.net/PAEReview/issue69/Varoufakis69.pdf

Varoufakis details one of the most damaging charges against Piketty in both his writing and in interviews: that Piketty conflates too many things into Capital that shouldn’t be there. There is more about this in the Piketty — Varoufakis — George Notes below, and in the later category (George, as in Henry George), many Georgists, whether formal economists or not (like me) almost immediately noted that Piketty’s failure to disaggregate returns on non-capital Land is a major failing in his analysis, actually fatal to his opening ‘Law’ (Separately, Georgist professor Mason Gaffney writes in his own critique that this ‘Law’ does not even rise to the level of hypothesis, let alone theory, or ‘Law’). But even beyond that, there is another area involving labor which both Piketty and Varoufakis overlook as a major contributor to wealth, albeit for a limited historical period, Varoufakis by omission, and Piketty by commission because it is Piketty that “folds in” slave labor from America during 1770-1860. He uses U.S. Census data to include the value of slaves during this critical period in our then-young country’s history, concluding that in 1860, according to the last census before the Civil War that would end slavery, that slaves constituted 40% of the wealth in the South.

This is a big asterisk then, and while it shows Piketty’s consistency, it also shows how willing he is to include virtually anything that is considered, however hideously, as Capital, in his calculations. This genuflection to a legal definition of capital over an economic one should give us serious pause when considering what other factors might be mislabeled “Capital.”

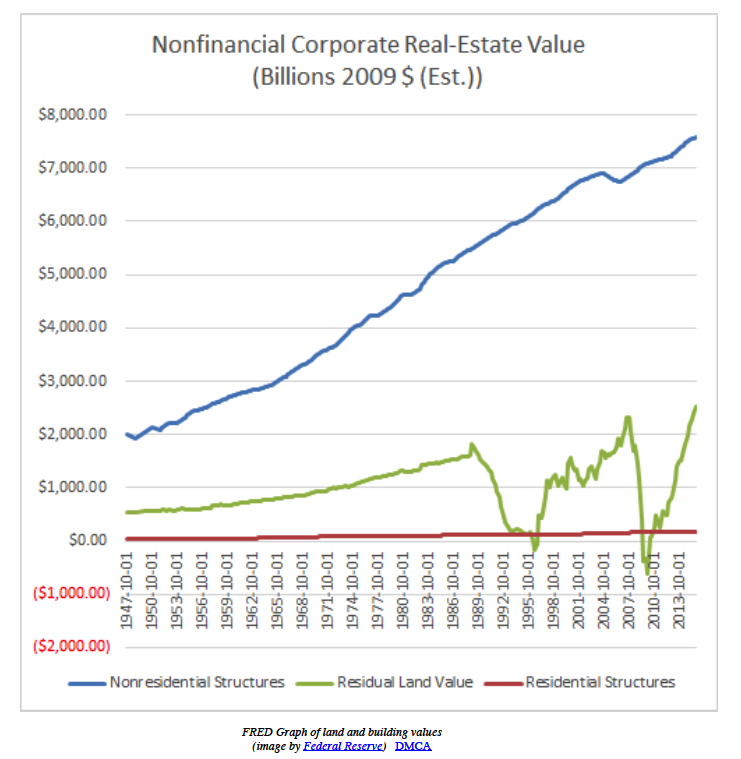

What else has Piketty included as capital that shouldn’t be? Land.

In a thorough critique of Piketty, “A note on Piketty and diminishing returns to capital” by Matthew Rognlie, the 26-year old MIT student argues that Piketty’s return to capital is entirely due to Land appreciation, not capital, which in any case, loses its value faster than ever in today’s rapidly changing technological environment (he cites the Apple iPod as one simple but instructive example). This is in sharp contrast to Piketty, who argues technological achievement is one of the things that gives modern “capitalists” greater returns on their investments than Laborers can get through wages.

Supporting this view further is former OMB Director under Obama, Peter Orzag’s Bloomberg column “To Fight Inequality, Tax Land” in which he argues:

In the lasting debate over Thomas Piketty’s book on outsized returns on capital, a significant fact has been obscured: If you exclude land and housing, capital has not risen as a share of the U.S. economy.

If you’re surprised, you’re not the only one. Intuition suggests this capital-output ratio should be higher today than it was in the early 1900s. Yet, in the U.S., capital excluding land and housing has been roughly constant as a share of the economy since the mid-1950s, and is lower today than at the turn of the 20th century.

What has skyrocketed over the past several decades is the value of land and housing.

Orzag has some pretty good backup too, citing former World Bank president and noble prize winner, Joseph Stiglitz”

Stiglitz also argues for imposing a land value tax, to directly address this source of increasing wealth inequality. Economists have long favored such a tax, because it does little or nothing to distort incentives: Since land is roughly fixed in supply, there’s little one can do to escape a land tax. Indeed, from the perspective of economic efficiency, a land value tax scores higher than even a value-added tax, which is typically seen as the most efficient form of taxation.

Also cited is the political economist/journalist who started a serious theory of Land as the basis for just and sound economic policy: Henry George

Sometimes old ideas are good ideas. Henry George advocated forcefully for a land tax in his 1879 book, “Progress and Poverty.” More than 135 years later, perhaps its time is ripe.

Orzag concludes:

So here is a bold idea for a national candidate: Propose a national land value tax. It would highlight the fact that, except for land and housing, capital ratios have not risen here, despite Piketty’s rhetoric. It would also be economically efficient and reduce wealth inequality. The revenue could be used to reduce other taxes, or to help close the actuarial deficits in our entitlement programs, or some combination thereof.

As I re-watched the November 24, 2014 Smart Talk interview between Andy Mazzone and Yanis Varoufakis, I took the following notes and added more thoughts parenthetically:

Piketty — Varoufakis — George Notes

Mazzone points:

1. We have a broken neoclassical model

2. Capitalism has inexorable outcomes but no empirical explanation for them is provided by Piketty

3. There are accidental good times (e.g. WWI — apx. 1980) but these are treated as exogenously caused and without explanation

4. Piketty conflates wealth and capital — Varoufakis agrees

Varoufakis and Mazzone points:

1. Piketty is helpfully bringing inequality into established mainstream of economics profession. In neoclassical economics there is no place for inequality due to Utility Theory. This solves the disconnect between what most Americans thought and how economics has been practiced.

2. Inequality was banned from neo-classical economics because it uses a Utilitarian model where utility justifies all levels of inequality based on intelligent consumer preference and that one’s output cannot be compared to anyone else’s outside of this ranking.

3. Piketty finally made it so that the economics can say something about inequality after all.

4. (Andy/Yanis) Piketty offers no theoretical basis for inequality (In Piketty’s defense, it should be noted that he says his book is as much a work of history as economics. It would be interesting to see an historical critique of Piketty then, not just economic critiques), but Varoufakis says the theoretical construct is consistent with neo-classical textbook, but it can be disregarded eventually because it has no substance: 3 laws.

a. Law 1 is a tautology r>g (capital grows faster than national product)

b. Law 2 based on assumption that can’t hold in reality

c. Law 3 is trivial

5. Conclusion is weak, just a wealth tax with no distinction between capital, labor and land wealth.

6. Very few read all the way through Piketty’s book (Amazon reviews confirm this “early pages” bias).

7. Paul Krugman praised the book, though he should know better (Andy). Krugman is an academic economist who sees the world as a single sector economy model (Yanis) and is coached in terms of the IS-LM model (Investment Saving-Liquidity Preference Money Supply) — a macroeconomic tool that demonstrates the relationship between interest rates and real output, in the goods and services market and the money market. IS-LM acts as if there is only one “capital good” (Yanis) and it just interplay between availability of money vs. other capital goods. Returns to capital are not difficult to envisage in one-capital good model. This model does not need money, only trade.

8. Neoclassical models not capable of “handling money.” It is too complicated a concept. The models predict anything is possible and so are “useless” and not predictive.

9. (Yanis) Krugman uses his simply IS-LM model to do good things. Piketty much less interested in changing the world than Krugman, more a describer. Both Krugman and Piketty share an over-simplified view of capitalism.

10.What policy prescriptions can you take from Piketty? (Andy). There’s no bargaining power in Piketty’s formulation because we’re all “cogs in the machine” (e.g. The Matrix). This is not capitalism (Yanis). Piketty assumes prices are given and the “market” has determined them to everyone’s satisfaction.

11.(Andy) Piketty says tax all wealth, including money (which is most wealth these days, at least on paper), and he doesn’t disaggregate it (e.g. Land, true Capital),

12.”Rooseveltian reforms are off-the-table”

13. Piketty is writing “propaganda” not solutions (Yanis). Problem is we “can’t measure capital” as long as we live in a multi-commodity world. Doomed to mis-appreciation like love or beauty. Piketty chooses to measure wealth instead, not measuring capital at all. Everything is the same — Grandmother’s silverware to robotic assembly line, to stocks and bonds. Would force grandmother to sell silverware to pay the wealth tax.

14. No distinction for productive vs. non-productive assets. Would tax machinery as well as Land, stocks and bonds.

15.(Yanis) Piketty not interested in solving inequality, but in becoming the guru of inequality and connecting to the social sentiment that there is something wrong with inequality. This makes Piketty a great enemy in the end of pragmatic egalitarianism (perhaps this is why his book was so heavily promoted? — SB)

16. Piketty has formed economic committee to address how to change inequality.

17.(Yanis) Piketty has formed another group in France to do something about collapsing Eurozone. Have published a manifesto. However, (Andy) his book does not support direct gov’t intervention. But (Yanis) he is allowing this because he knows democracy is imperiled.

18.Reminds Yanis of debate between John Rawls and Libertarian Robert Nozick. “Piketty is a second rate version of John Rawls (book “Theory of Justice”, pub. 1971). Rawls mechanism for passing judgment on the justice of society was to imagine random scattering of rich and poor etc. Rawls was a re-distributionist as well, like Piketty (SB — Robert Reich too). Nozick destroyed Rawls in his 1974 “Anarchy, State, And Utopia” by saying: “Well, OK, we have distributed wealth as Rawls says, but what happens if someone develops wonderful skills at Basketball? And everyone wants to pay large amts of money to this star player. But allowing people to pay excessive amounts to player would allow skewing of wealth. So, allow it and destroy distribution or disallow it and prevent talent?” But market is not fair (Yanis — and me). Piketty too will be destroyed by Libertarian argument, even more so. Piketty has nothing to say about the process, only the outcome, and it is too late then.

My thoughts after watching the video:

Piketty may be sincere, despite what Varoufakis says, but his analysis is shallow and data-dependent on the easiest data to obtain. That is, he relies on data to drive his theoretical construct, which is at times incoherent anyway, rather than building a construct supported by data. This produces a result that shows what happened from a historical-economic perspective, but not why. He conflates anything that is remotely wealth as “capital” as both a way to explain inequality and also to enhance his book’s impact (it would be far less powerful if his book was entitled “Capital in the 21 Century” but had an asterisk saying “*Includes: Land, Slaves, and makes no distinction between earned wealth and rent wealth due to monopoly.” Such an asterisk would give away the game right there.)

Piketty’s data-driven model is so weak it invites anti-progressive libertarian attack, even by nominally progressive people, since it doesn’t allow for wealth based on production, or even for disallowing taxing Grandmother’s silverware set. The more recent ad-hoc Piketty economic committees are fine as a concept, but may not support Piketty’s limited viewpoint, so in the end are not going to be effective due to lack of clear theory.

But, the Georgist model was not given enough thought by Varoufakis either, and he too glibly conflates wealth and land value (which is never mentioned at all in the interview). Disaggregating land value and then suggesting taxing that would open the door to a new form of equality — based on process, not result — that in the end would produce something more fair than we have now. There would still be relatively poor, but not nearly the extremes as we have now. These extremes cannot exist without some form of unearned income from monopoly. The innovative market simply will not allow for it if it is allowed to function as it should. Piketty ignores this, or, at best, just assumes it is an unavoidable part of capitalism, except for great wars when everything is disrupted. Gaffney makes the point in his critique that Piketty is ignoring “non-shooting wars” in his period of relative equality — 1914-1980. Policy plays no part in Piketty’s world, or at best is a very weak and temporary brake on the rampant accumulation of capital at the top (again, conflated in his analysis) over national growth.

Notes on Piketty’s book: Capital in the Twenty-First Century

Reviews can be like a second article or book. The Reviewer, consciously or unconsciously reveals his bias in selecting what to highlight or critique. There is no substitute for reading the original, especially in the case of a tome like Thomas Piketty’s 685-page “Capital in the Twenty-First Century, even if “only” 577 pages are text and the rest mostly endnotes; some of those endnotes can be important too!).

In preparation for the Webinar I reviewed the notes I had taken when reading the book, though doubtless I note-took with my own biases, unquestionably in the Georgist direction to disaggregate Land from Capital, and in the Greenbacker direction to question the monopoly on money-creation by private parties. Still, I believe the notes have value, especially if one isn’t going to read the “original source,” Piketty himself.

Here they are, in slightly cleaned up form with page numbers referring to the hard cover edition and my reactions to Piketty’s thoughts in italics. Especially important points are in bold. I provided some links for the uninitiated.

1. Difference between property in 1900-1910 and now shown — page vii

2. Return on capital exceeds return on output and income — page 1

3. Inequality used to be even larger than today. Piketty refers to Jane Austin and de Balzac as good and accurate literary sources for early 19th century.

4. Land rent increases during Thomas Malthus’ time due to population growth — page 4

5. Malthus wrote during time of European revolutions — France, England (potential) — page 5

6. David Ricardo failed to appreciate the rise of technology and industry when he was writing his thesis. Too much emphasis on agricultural land — page 6

7. Urban land disequilibrium discussed — page 6

8. Inequality was extreme up until WWI — page 8

9. Says law — “Production creates its own demand” — page 9

10. Marx failed to use all sources available to him at the time or to account for continued technological progress.

11. Kuznet’s curve — the early to mid-20th Century tendency for all incomes to equalize due to technological progress. But this optimistic outcome was disproven by the 1980s — page 13. This lack of progress may be due to the cold war — page 14 or world wars — page 15 says Piketty, but I believe has more to do with profound policy changes favoring rentiers over producers.

12. Piketty relied on tax records for income calculations — page 17. But these can be incomplete and subject to evasion, particularly by those with the most to tax. Gaffney notes this in his critique too.

13. World Top Incomes Database (WTID) is Piketty’s primary source of data — page 17

14. Income is defined by Piketty as deriving from both wages and capital income (rent is included in his calculations, though much of this is based on land and not the result of labor) — page 18

15. Piketty also uses estate taxes in calculations — page 18

16. 2 optimistic assumptions have been proven wrong:

a. Class warfare will be replaced by generational warfare.

b. Education will equalize opportunity — page 22

17. Slow growth correlates with high income and wealth inequality, but Piketty does not emphasize that connection enough or its socially destructive potential — pages 25, 42

18. r>g: formula meaning rate of capital growth exceeds rate of national growth. — page 25

19. Piketty discusses mostly U.S., Japan, Germany, Italy, France and the U.K. because that’s where the long-term data is best. But does this mean the results might be different in other countries with different systems? Also, Gaffney points out that data for Germany, France and Italy is non-existent before ca. 1850 when they became countries, and sketchy at best for the U.S. before then too.

20. Inheritance played a smaller role in U.S. inequality historically due to early explosive population growth. — pages 28-29 Also, unmentioned, the presence of a large amount of free land in the frontier with which to build wealth.

21. Piketty says his book is as much a work of history as economics — page 33

22. Piketty’s example of conflict between labor and capital in Johannesburg is really between Labor and Land (mine) owners — page 39. 34 miners were killed for striking. What if rent on gold was distributed to the community whose land it was found on instead?

23. Piketty fails to distinguish between land and capital again — page 42. Does Piketty understand locational value?

24. What is capital to Piketty? — page 46. He says it is not human capital (except when he includes slaves 1770-1860), but he includes Real Estate, which includes land (page 42). He doesn’t separate land and other capital because he says it is too hard to separate them, but this is a fatal methodological flaw!

25. No distinction between wealth and capital because it is simpler that way — p. 48

26. Fixed capital includes buildings, infrastructure and land (to Piketty). Equals – total capital in developed countries — page 48.

27. Claims (falsely) that private wealth is almost all national wealth because debts balance out assets — page 48.

28. Foreign assets balance out between countries — page 50

29. Output growth broken into 2 parts population growth, and per person output growth — page 72. The latter is historically under 2%

30. Piketty believes growth will slow to historic norm of .1%/year due to population slowdown– page 74. But there is no evidence that rapid population growth necessarily leads to high output growth (e.g. See Malthus), so why should reverse be true?

31. Inheritance is less important when there is strong demographic growth — page 84. Lower demographic growth means more inequality due to relative higher importance of inherited wealth.

32. No country’s growth is >1.5%/year over long periods — page 93. Does China or India disprove this now that they have exceeded this level for over two decades?

33. Oil must be replaced to maintain growth — page 95

34. There was strong growth post-WWII because of strong State intervention in the economy until about 1980. But then why doesn’t Piketty call for more intervention now, instead of assuming a slowdown in growth is inevitable? — pages 98-99

35. There was no change in money conversion rates in 19th century. — page 105

36. Great levels of debt began after WWI — page 106

37. High inflation began in 1913 (Federal Reserve Act came slightly before inflation due to WWI) and until 1950 — page 107

38. 19th century wealth was in land or bonds — page 113

39. Piketty admits land is a special form of wealth — page 114 But still does not treat it separately when discussing capital accumulation.

40. First identification of rent-seeking — page 116

41. Housing chart on page 116-117 disguises land wealth. Also, agricultural land has been replaced by buildings, business capital, financial capital — page 118

42. Government debt nets to zero because it is an asset to private sector (this mirrors the philosophy of Modern Monetary Theory). — page 118. But not all debt is actually sovereign and Piketty misses that.

43. Piketty finally acknowledges that “housing” can be broken down into land + actual houses — page 119

44. National Capital = farmland + housing + other domestic capital + net foreign capital — page 119

45. French and British rents transferred abroad — pages 120-121

46. Capital is defined as difference between what one owns vs. what one owes, but Piketty does not project out to future ownings and future debt where the ratio might change — page 123

47. Sovereign wealth funds have arisen to manage sovereign wealth. This disproves Piketty’s earlier contention that governments are essentially without assets because debts balance out assets and net to zero – page 124

48. France paid debt by inflating it away or defaulting on 2/3 of it during revolution in 1790 — page 130. Is this a lesson for Greece and others today? Countries aren’t allowed to “reset” so easily anymore.

49. Public and private debts grew to unprecedented levels in early 19th century. Bonds replaced land as income — page 130

50. 19th century France paid more in interest on bonds than on education — page 132. Taxes went in large part to bond holders.

51. Landlord wealth is only 3 times national wealth in the U.S. vs. 7 times in the U.K.

52. Slavery was added to wealth and increased 10 times from 1770-1860 according to census — page 158. This amounted to 40% of the South’s wealth in 1860.

53. Is Piketty’s capital/income the best measure of national inequality? It doesn’t account for large individual discrepancies in capital/income ratios. — page 166

54. Capital accrues faster to wealthy people in a slower growing economy. Faster growing economies will have less savings but more opportunities — page 167.

55. Second fundamental Law of Capitalism: -‘= s/g Formula: capital/income = -‘ Savings rate = s; growth rate = g. “If s = 12% and g = 2%, then -‘ = s/g = 600%…meaning in the long run a country will have accumulated 6 years of national income as capital. Piketty says this formula does not work if natural resources are included — page 169. Georgists say natural resources SHOULD be included!

56. -‘ = s/g also does not work if asset prices grown faster than consumer prices — page 169.

57. The formula also does not account for shocks like world wars.

58. Piketty acknowledges speculation drives asset market prices — page 172. But he does not provide an alternative to dampen speculation such as Land Value Taxation.

59. Retained earnings are put back into stocks as a greater rate than economic growth, long term — page 176 – 177

60. Durable household goods not counted as savings, but corporate durable goods are so counted and their depreciation is written off taxes — page 179

61. Distinction between public and private wealth may be arbitrary, e.g. charities like foundations — page 182

62. In most rich countries, borrowing exceeded public savings/investments

63. All countries are privatizing assets — page 186

64. Rise in value of pure urban land does not account for rise in capital/income — page 198

65. Returns on capital higher than from labor — pages 205-206 and were 4-5% in the 19th century.

66. Rental value of housing is 3-4% but housing is – total national wealth — page 209

67. Real estate and financial wealth account for “bulk of private wealth.”

68. Too much capital kills return on capital — page 215

69. 30% return to capital was the norm after WWII — page 218 (But this is too simplistic)

70. Capital tends to replace labor over time page 221 Gaffney makes the point that tractors (capital) actually replaced the land that was used to feed draft horses on farms — about 1/3 of the typical farm — and not labor. There are other such examples that contradict Piketty’s big pronouncement.

71. Income from Capital defined as any income not from labor, including rent — page 242 (but see important “slavery” exception 1770-1860)

72. Inequality resulting from difference in capital returns always greater than inequality resulting from difference in labor returns — page 244

73. Top 10% of labor receives 25-30% of labor income. Top 10% of capital receives 50% of capital income, up to 98% in some societies. See charts of labor and capital inequality — pages 246-249

74. In U.S., top 10% of laborers make greater return than bottom 50%

75. Half of population own virtually nothing — page 257

76. No society has ever existed in which capital inequality is only mild — page 258

77. Wealth is so concentrated that the bottom 50% is almost unaware of its existence. — page 259

78. The truly wealthy become that way through stock and business partnerships — page 260 Prof. William Lazonick and others have documented that as much as 90% of corporate profits are plowed back into buybacks and dividends, leaving just 10% to grow the business, so this makes Piketty’s observation much less benign

79. 1900-1910 Europe — The richest 1% owned 75% of all wealth — page 261 This puts into question the commonly assumed “revolution tipping point” at lower GINI ratios or when the wealthy 1% own about 40% of the wealth. Why the difference? Might historical royalty allow for greater wealth inequality?

80. Today’s middle class lays claim to – to 1/3 of national wealth. Middle class in Europe gained at expense of wealthy — page 262

81. Piketty says revolution probable when wealth gets too concentrated — e.g. 90% of wealth in top decile — page 263. But 50% makes it more likely too.

82. Inequality is more achievable through rentier societies, “patrimonial societies” that pass wealth through inheritance — page 264

83. One can be both a “super manager” and a rentier — page 265

84. How inequality is measured is not a neutral phenomena — page 270. You don’t say”

85. Rentier income fell by 2/3 in France in the 20th century — page 274

86. Today, unlike in the past, only the very top derive income from capital — page 277

87. Rentiers fell behind super-managers — page 278 Is this really true? What about rent from intellectual property via patents, or from stock options, or from mineral resources or pollution a company produces that it is not paying a fair price for (externalities)?

88. The next 9% under the top 1% enjoy an 80/20 income/capital splits, but capital income is under-reported for the top 1% – page 281

89. Income taxes are becoming an unreliable source of income statistics. Gaffney argues they have been that for some time.

90. The 9% under the 1% fared better during the depression — page 285

91. Capital gains taxes are at unsustainable low levels — page 285

92. Increase in inequality contributed to instability — page 297

93. From 1977-2007 the top 10% got 3/4 of the income growth and the top 1% got 60% of that — page 297

94. The rise in inequality is not explained by changes in education and technology — page 304

95. Power of special groups may determine wages, not their productivity — page 305

96. Education can’t explain gap between the top 1% and next 9% – page 314

97. Japan and Europe are not as unequal despite being as technologically advanced as the U.S., so technology and education premium does not make sense as a cause of inequality — page 330

98. Compensation changes since 1980 largely responsible for CEO wealth gains — page 333

99. Superior corporate performance does not correlate with high CEO pay — page 334 Also, my article here: http://www.opednews.com/articles/High-CEO-Pay–Low-Company-by-Scott-Baker-091231-794.html

100. Top 1% owned 60% of the wealth in 1900-1910 — page 339

101. Top decile in France owned 80-90% of total wealth — page 342

102. Piketty conflates rent with capital — pages 353, 359

103. Inequality dropped from 1914-1945 and has not yet returned to previous levels — page 372 But the trend is in that direction!

104. Rentiers no longer make up top 1%, but super-managers do — page 373

105. Inheritance tax rates went from 1-5% to 20-30% during WWI, leading to more equality — page 374

106. In Germany, estate tax is half that of France — 15-20% – page 374

107. Piketty claims capital was once land but is now industrial, financial and real estate, but isn’t Real Estate mostly land? — page 377

108. In the 21 century, one can be a small or medium rentier and a super-manager — page 378

109. Lower mortality in second half of 20th century partly explains lower inheritance rate — page 387

110. “The logic of r>g implies that an entrepreneur always tends to turn into a rentier.” — pages 395, 411, 420. This contradicts his earlier statement that rent-seeking has given way to running businesses and being a super-manager.

111. Tax competition among nations and regions can lead to inequality and slower growth — page 422

112. Rent has been redefined by the 20th century as “income on any capital” — rent, interest, dividends, profits, royalties — page 422

113. Rent is now simply return based on ownership, independent of any labor. Rentier has now become an insult — page 423

114. Piketty makes no distinction between rent on land and rent on true manmade capital — page 424

115. Inherited wealth likely 50-60% of private capital — page 428

116. Slowing of population growth means inherited wealth will become more important — page 428

117. Forbes showed billionaires increased from 5 per million (1987) to 30 per million (2013), from .4% to 5% – page 433

118. Top 1% owns 50% of global wealth — page 438

119. Merit alone cannot account for wealth inequality and money grows on its own, independent of owner merit — page 443

120. Entrepreneurs turn into rentiers — page 443

121. Inflation is not detrimental to assets if it is low and assets are invested wisely — page 453

122. Rents to sovereign funds are climbing but currently at 1.5%

123. Annual rent on natural resources is currently just 5% – page 459

124. Wealthy residents of rich countries are hiding assets and making trade balance appear negative when it isn’t — page 467

125. Piketty calls for a global progressive tax on capitalism, but then dismisses it as utopian himself — page 471

126. Share of taxes as part of national income rose 3-4X post WWI — page 476

127. Welfare spending is small — page 478

128. Growth of social state accounts for growth of state spending — page 479

129. Tax rates are regressive for top 5% – page 496

130. Absence of progressive tax implies support for globalized economy. Countries with tax cuts at top have most income inequality — page 508

131. Executives fought for huge raises only after 1980, when tax rates were lowered from 80-90%, but reductions in top rates have not stimulated national growth, just the opposite has occurred — page 510

132. Growth rates the same in U.S. and Europe over past 3 decades — page 510

133. U.S. growth rate higher 1950-1970 then from 1990-2010 — page 511

134. Incomes of over .5 — 1 million should be taxed at 80%, says Piketty – page 513

135. In favor of Real Estate taxes — page 517, but Piketty vastly understates revenue from this at only 1-2% of national wealth

136. Global wealth tax would force reporting of assets — page 520 and this should be automated — page 521

137. Force all banks globally to report holdings.

138. FACTA requires non U.S. banks to report holdings — page 522

139. Countries less powerful than global patrimonial capitalism — page 523

140. Impose 30% tariffs on countries that don’t release bank data — page 523

141. Income for the wealthy is hidden in trusts etc. — page 525

142. Piketty wants to replace property tax with wealth tax — page 529 Bad idea. Wealth in non-land forms is easy to hide, compared to land, which also cannot be moved offshore.

143. Calls for progressivity in taxation — page 530

144. Land rent seen as stable, good, income in the 19th century

145. Property taxes suffer from bad assessments and lack of progressivity — page 530. Actually progressivity is built-in since wealthy people tend to live on more valuable land. Assessments can be made more honest and better.

146. China has capital control and capital regulation — page 536

147. Piketty claims public wealth is close to zero due to debt — page 541. Apparently, he’s never read a CAFR – click here

148. Inflation would take decades to work down debt — pages 544-545

149. Taxes far better or reducing debt than inflation — page 547. Sovereign, debt-free money is better still – http://www.opednews.com/articles/Debt-No-More-How-Obama-ca-by-Scott-Baker-Banks_Constitution-In-Crisis_Constitution-The_Constitutional-Amendments-131018-391.html

150. Milton Freidman’s “Monetary History of the U.S.” in 1963 led to the Chicago School rejection of big government and the conservative revolution of the 1980s — page 549

151. Central banks do not create wealth, they redistribute it — page 550

152. ECB, BOE, FRB has doubled to 20% of GDP — page 552

153. Piketty suggests a corporate tax be deducted from shareholders based on global database of wealth — page 560. This can be progressive too.

154. Apportion taxes based on sales and wages paid in each country — page 561

155. Too much capital accumulation retards growth — page 563

156. There should be no prior constraints on Euro debt — page 566

157. Net private wealth in Europe has never been so high — page 567

158. Piketty calls for annual tax on capital to be global — page 572

July 31, 2015

The Real Lessons in Greek for Leftists

By Scott Baker

The Greeks are in line for another bailout, or are they? Who is really getting bailed out here? What can Greece do to prevent capital flight? The answers here…

::::::::

The problem of capital flight Steven Jonas identifies as happening in Greece and as a cautionary tale for Leftists, is not as hard to deal with as it sounds. There were two part-contemporaries of Karl Marx, cited by Jonas who effectively did it, without that being even their main objective: Henry George (1839-1897) and President Abraham Lincoln.

How?

George came up with a formal and thorough description of a tax that has actually been around to some degree since the Old Testament (economists, like humans, have to re-learn the lessons of the past, over and over). It was called the Land Value Tax. The Land Value Tax is a tax on the site value of the Land, primarily though it is also a tax on resource-wealth and even, in modern form, on pollution. None of these forms of taxation, unlike taxes on income or sales, can be driven offshore — income taxes drive income offshore, while taxes on sales drive sales offshore. But taxes on Land (the classical economic term meaning ALL of nature’s resources and most importantly, location) cannot be avoided. This satisfies one of the cannons of taxation, first laid out by Adam Smith, who also advocated taxing landowners on their unearned income. Here they are (see slide 13):

1. Light on production

2. Easy and cheap to collect

3. Certain

4. Fair

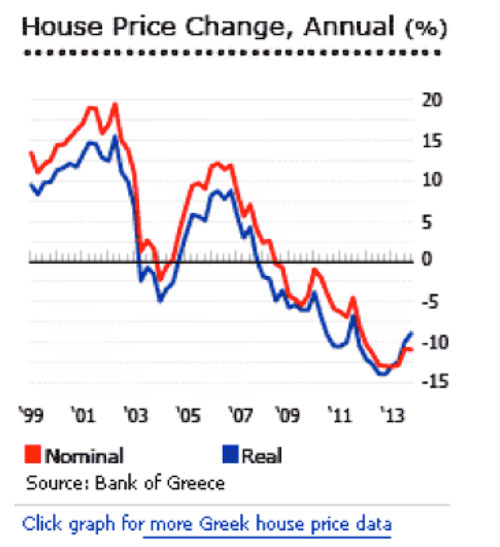

The Land Value Tax satisfies all of these, including #1 because it is merely collecting for the public good what the landowner currently collects for his private gain. It is also Fair (#4) because it is the community demand that created the value of the location in the first place. It is Easy and cheap to collect because locational value, apart from improvements like buildings which are untaxed, is something brokers and assessors have been determining for centuries, and it is easier than ever with modern computerized tools. The Land Value Tax, at least in this country, could raise trillions in America, as I document in my new book, “America is Not Broke!” and even in Greece, where the value of housing (read: Land) has declined 50%, there are vast under-taxed estates.

Rather than selling off public lands at fire-sale prices to the outside Troika or other vulture capitalists, Greece should retain these, and then collect full rental value on its private properties, which by definition cannot be moved offshore.

The other solution, which is not unique to Lincoln either, and indeed goes back as far as the Land Value Tax to the mists of time when money first became part of human society, is Sovereign Money, issued by the government not a semi-private central bank, or the network of private banks (either here or in Greece). Money, as both Lincoln and George realized, is too important to be left solely in the control of the money monopolist banks. The banks only care about having their debts repaid, not about the people or countries paying them, and not about the health of the economy. In fact, as former Finance Minister Yanis Varoufakis is finding out now, they will turn viciously on anyone who challenges their money monopoly.

The long knives are out for Varoufakis now: Supreme Court prosecutor takes action over Varoufakis affair.

And consultant and world-renowned economist, James Galbraith Jr. is named in a suit as well: Varoufakis facing treason charge for hacking accounts.

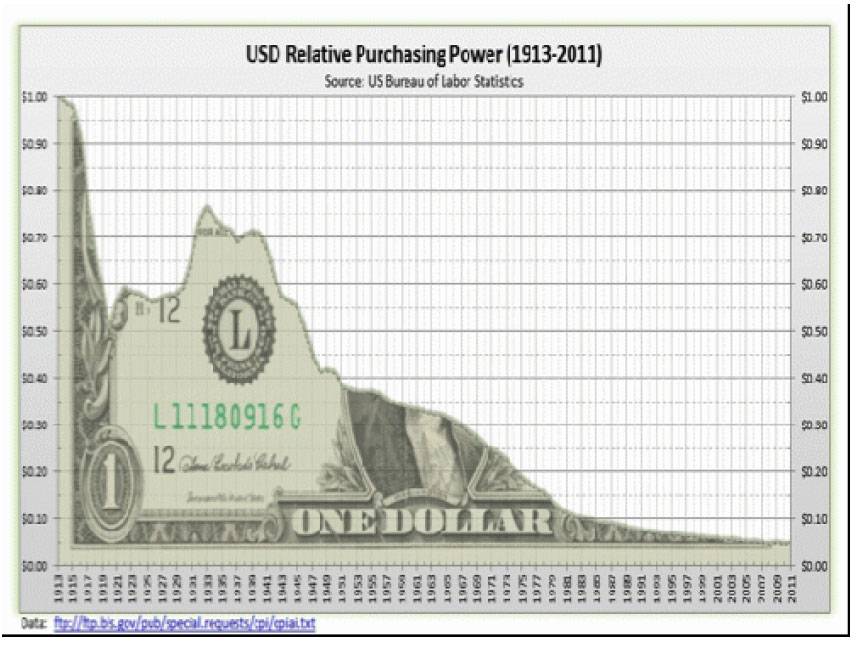

What’s next? Will they go after journalists for covering the story (including bloggers like me who advocate for alternate currencies too)? Opednews? This is really getting to be insane, but that’s what happens when money is monopolized by a completely unaccountable body dominated by the banks. This monopoly must be busted, and the way to do that goes beyond letting a few megabanks (aka Systemically Important Financial Institutions in the Fed’s nomenclature”which raises the question: important to whom???) fail. The monopoly on money creation itself must be defeated. And with proper respect to the dangers of inflation, this is the track record of the private Federal Reserve to the value of the Federal Reserve Dollar since inception in 1913:

Has the Federal Reserve managed the value of the Federal Reserve dollar well? Before answering that, consider that another form of dollar, a United States Note, can be bought for more than twice face value on eBay, and it’s that expensive precisely because it is so rare. So much for the government over-issuing money when it had the chance. The reality is precisely the opposite.

So, knowing of these two solutions, when president of the Henry George School, Andy Mazzone and I interviewed Yanis Varoufakis a year before he became Finance Minister for Greece, I asked him about issuing Sovereign Money.

I wrote in an earlier article: Will Greece or the EU Blink First, about that exchange:

From the interview in Fall of 2013:

Minute 6:20 Scott: This is why I advocate along with Henry George and other monetary reformers that we break up the monopoly of money creation itself and that that way the politicians are not going to be bribed by money because they have their own supply. Because it seems that politicians are very cheap in the world of finance that these bankers operate in (and) to buy off for congress is a modest investment from their point of view…

Yanis: I agree, Scott…

…and that they’ll continue to do it and the there’s no reason not to, as Andy says why they wouldn’t. But the only way to break that – I believe – is to break the monopoly on money as well as the monopoly on land and the land in the expansive sense as meeting all resources.

Yanis: I agree”

Scott: So if we don’t take this monopoly power away from the financiers in around two years then what hope is there for the actual productive class to have any sort of parity in the society?

Yanis: Spot on. I agree. I agree entirely. But there’s one danger in this narrative, not that I disagree with you, but we have to be very careful how we hone it because today there is, as you well know, there is a tea party/libertarian argument against the monopoly of money, against the Federal Reserve, against fiat currencies and in favor of a Hegekian (?) blueprint of privatizing money and effectively allowing private…banks to issue their own currencies.

Now this libertarian pipe-dream, which of course is never going to come to fruition, is a political bulwark against the agenda that you just outlined. So it’s…we must be very clear about this. It is not…the problem is not that we have state fiat money. The problem is that we have a Fed…a Federal Reserve System, in the United States, a European Central Bank in Europe, which is in the pockets of the private financiers.

And the task is not to undo the state’s control of money. The point is to strengthen it but to make the state operate…operate…utilize its control of money on behalf of manufacturers, on behalf of creative people, on behalf of all those whose lives are wrecked as we speak by the rent-seeking behavior of the financiers that control through the revolving-door strategy the regulators.

Minute 9:05

It’s clear Varoufakis agrees with the majority of economists in that economic demand must be increased.

Later, Mazzone and I discussed the possibilities for Greece a bit more and came up with this broad outline for a plan:

1. Issue drachmas for local consumption and spending. The amount should be enough to meet the 30% Output Gap, but not enough to cause too much inflation; the problem now, of course, is rampant deflation caused by too little money in circulation.

2. Agree to pay off the debt over 100 years, 1/100th per year. In reality, this will be the basis for negotiation, but it is a concrete one, something that has not been offered so far.

3. Use the devalued currency to encourage cheap tourism to Greece and exports. Tourism growth estimates vary considerably but 16.7% is a good mid-range calculation in 2014, and tourism remains Greece’s main economic engine, supporting 53 job categories.

4. Tax the large landowners with a Land Value Tax.

Now, it’s later, and it’s now clear that Varoufakis was working on an alternate currency option all along, understandably in secret since the monopolist banks would never allow it if they had known. The banks would have withdrawn liquidity from the Greek banks, as indeed they did, when there was even a hint of rebellion against their illegitimate demands (illegitimate because banks should be subservient to the government, not the other way around).

These options still exist, and it’s hard to see how Greece digs itself out of the debt hole — soon to be 200% of GDP — without them. The banks, aka the “Institutions” have no intention of writing down the debt, even though they know it cannot be paid. Why continue with such an illogical demand?

Because it is the banks, not Greece, which are being repeatedly bailed out.

Varoufakis identified this trend too, but now even the NY Times has written about it, Bailout Money goes to Greece, only to flow out again: