EDWARD J. DODSON

January 9, 2007: The Progress Report

Every study prepared and commission report issued on the decline of housing affordability identifies regulation (e.g., low density zoning) and other delays in obtaining development permits as primary culprits. What we see across the country is widespread concern, particularly in suburban and rural communities, over the potential problems of environmental degradation, worsened traffic congestion, increased property taxes for schools and the cost of infrastructure expansion, and loss of open space. Responding to citizen concerns — and sometimes having development proposals rejected because of them – – does add to the cost of housing development. But, what must be understood is that even should such “anti-growth” resistance be substantially reduced, housing will not become more affordable without other very specific public policy changes. A brief examination of how communities develop reveals why even the potential for changes in regulation will exacerbate rather than help make housing more affordable.

The earliest suburban communities spread out from the rail lines linking those communities with the urban center. As public infrastructure was extended beyond the cities, farmland became increasingly more developable for residential, commercial or industrial use. Developers and land speculators bought out many farmers (who often took their profit in increased land values to purchase much larger farms in more distant locations). The developers obtained approval for large subdivisions of homes, and the speculators waited for the price of land to rise ever higher. Beginning in the 1950s, state and Federal subsidies for highway programs expanded accessibility into areas not served by “mass transit.” New communities sprang up seemingly overnight; and, because many speculators continued to hold their sites off the market, development was forced to more and more distant locations — absorbing farmland and open space.

During the 1950s and 1960s, the cost of suburban land for housing, although increasing, was still relatively inexpensive; and, people wanted space between themselves and their neighbors — a luxury few enjoyed as city dwellers. As a result, minimum acre or lot size zoning was adopted to protect the character of suburban communities. Ironically, a secondary reason for this type of zoning was to reduce the potential for overdevelopment. However, as vacant land disappeared (or was being held for speculation), the price of land was driven up considerably and developers were forced to ever more distant farming areas to find land on which they could build houses people could afford.

The tendency for land to increase in value does have limits. Widespread unemployment and recession cause land values to fall like a house of cards hit by a stiff wind. Even when economic conditions are favorable, land prices are subject to downward pressures that include the household income of potential homebuyers, the market rate of interest charged by lending institutions for mortgage loans, the costs associated with actual construction of housing units, and the impact of public policies such as zoning and taxation.

When a developer makes an offer to a farmer, speculator or other landowner for a site, zoning and other development costs are important components in determining the maximum price that can be paid while still looking forward to a reasonable profit. If land prices are rising and the present owner is under little financial pressure to sell, the developer may be forced to pay much more than the development plan can absorb. One way to change the financials is to apply for a zoning variance that would permit a more intensive use of the site (i.e., higher density or high-rise development). When such variances are approved, however, all other landowners will thereafter capitalize this potential for higher density development into their asking prices.

Another public policy with direct and normally negative impact on housing affordability is the property tax. Most communities do a very poor job of assessing undeveloped land to reflect increases in market value. Housing, on the other hand, is heavily taxed, taking homeownership out of the reach of many families who might afford a basic mortgage payment but cannot afford the extra $100-$300 a month in property taxes. If the annual cost to landowners of holding land equated to its annual increase in value, far less land would be held for speculation and the price of land would stabilize and gradually decline. With more landowners offering their land for development, the costs associated with site improvement (i.e., bringing in streets, utilities, sewer and water lines, etc.) would be absorbed by landowners in the form of lower prices. Herein lies the key to housing affordability.

August, 2015: Edward J. Dodson on Land Value Taxation

We recently spoke with Edward J. Dodson, a resident of Cherry Hill, New Jersey, and a member of the Green Party and director of an online education and research project called the School of Cooperative Individualism. He is a graduate of Shippensburg and Temple universities and a contributing writer to several publications devoted to improving public understanding of political economy.

Does the Green Party see a need for property tax reform?

The platform of the Green Party of the United States calls for the public collection of what in economics is referred to as “Community Ground Rent”, or what a user of land would pay to lease a parcel or tract of land, by means of Land Value Taxation (LVT). This involves changing the way real estate is taxed so that housing and other buildings are no longer taxed, leaving only the value of land in the tax base of our cities, towns, townships, boroughs, counties and school districts.

What is the past and present status of LVT?

Currently, Pennsylvania and Connecticut have enacted legislation to permit communities to move in the direction of LVT. Connecticut’s measure is recent and is designed to test the concept as reported in Commons Magazine: “On June 20, 2013, Connecticut Governor Daniel Malloy signed into law an act permitting—as a pilot program—a tax reform that turns traditional taxation on its head, as it also embraces the idea of the commons as a resource for the community to provide for the everyday public life of urbanized areas. That program is land value taxation (LVT). Initially, three communities will have the opportunity to apply for permission to use the program, with more to follow if LVT is proved successful.”

Some Pennsylvania communities have been slowly moving this direction for decades. At last count, 16 Pennsylvania cities (including Harrisburg, the state capital) and two school districts tax the assessed value of land at a higher rate than is imposed on building values. This gradual approach is generally referred to as the “two-rate property tax.” The results of this change in taxation are demonstrated by the Harrisburg experience as reported in PM Magazine in 2010: “In 1980, Harrisburg, Pennsylvania, was cited by the Department of Housing and Urban Development as one of the nation’s most distressed cities. It had lost 800 businesses and a third of its population in 20 years. Mayor Stephen Reed initiated the two-rate tax in that era, reducing the tax rate on buildings to one-half the rate on land.

Reed, who continued as mayor until January 2010, credits the reform with playing a major part in reversing the city’s downward slide. Most of the 5,200 stores and housing units that were closed when he took office are replaced or back in use. Since then, new construction and rehabilitation of existing structures increased the city’s taxable real estate from $212 million to over $1.6 billion. Businesses on the tax rolls rose from 1,908 to more than 9,100 by the start of 2009. Seeing these positive effects, Harrisburg reduced its tax rate on improvements to one-sixth the rate on land.”

The Philadelphia-based Center for the Study of Economics (CSE) has over the years prepared studies for city officials interested in the adoption of LVT. UrbanToolsConsult.org reports that in 2011, “Altoona became the first U.S. city to impose no property tax on buildings.” The website also says: “(LVT) is rational taxation of immovable property (land). LVT can be a major tool for strengthening the development market in cities, reduce taxes for productive citizens and businesses and provide a progressive, fair and equitable source of public revenue.”

Economists generally agree, including William Vickrey, winner of the 1996 Nobel Prize in Economics, who said in the Federal Reserve Bank of St. Louis Review in 2005, “The property tax is, economically speaking, a combination of one of the worst taxes—the part that is assessed on real estate improvements… and one of the best taxes—the tax on land or site value.”

Why is this tax issue important?

As citizens, it’s important that we understand that all taxes are not equal. LVT is recognized by many economists, planners and environmentalists as a powerful tool for slowing the development pressure on the open space and agricultural land that still surrounds our cities. According to a report issued in 2000 by the Institute of Government & Public Affairs, University of Illinois, “At first glance, there would appear to be no obvious link between property taxation and sprawl. However, the connection becomes clear when the lessons of the long-standing debate on land taxation and its virtues are recalled.”

How can readers get involved?

They can learn more about this important public policy issue by an online search on Land Value Taxation or Land Value Capture. I am happy to respond to any inquiries.

Dodson can be contacted at edod08034@comcast.net.

Preventing the Next Financial Crisis

Edward J. Dodson

Many economists in the United States are presenting a cautiously optimistic picture of the future of our economy, conditioned in part on a gradual recovery of “housing” prices as a significant driver of economic activity. Remarkably, despite the decline in nominal household net worth attributable to declining property values, household spending increased over the summer. The number of people who feel financially secure and/or optimistic about their employment situation has infused the United States economy with a raised baseline of spending.

An important question left unanswered is how much of this spending has occurred out of household savings versus the use of relatively high-cost consumer credit. Although government reports over the last few years indicate a decline in consumer debt, some of this is the result of individual bankruptcies and more stringent credit standards re-established by the banking sector. BEA reports an annual savings rate of 3.5 percent in November; however, what is far more important is the distribution of household savings across the population. And, here, the picture is grim. As Daniel Gros (Director of the Center for European Policy Studies) wrote earlier this year:

“… in the U.S., the increase in the average savings rate is obscured by an income distribution which is so skewed toward the top that a large fraction at the bottom of the distribution barely gets by and is even less able to save today than before the crisis brought about high unemployment.”

And, with continued high unemployment comes worsening chronic poverty and increasing demands on government social welfare programs. More and more households and individuals survive only because of the government safety net and the efforts of charitable organizations. Corporate leaders in the United States seem slow to realize that household poverty is a growing threat not only to the future of our economy but to the stability of our society.

When Kate O’Sullivan reported in this month’s CFO Magazine that “GDP in the third quarter grew by 2.5% roughly in line with economists’ expectations” she repeated by her absence of analysis that this increase in GDP is not indicative of the real economy experiencing growth. It is the result of government borrowing and spending. Too few economists and other analysts are raising the crucial question of where, absent fundamental tax reform, the revenue will come from to continue to pay for public goods and services. At some point in the near future public revenue will be insufficient even to service the skyrocketing federal debt. Cities look to the states for revenue, and the states look to the federal government for revenue. At the moment, the federal government looks to the Federal Reserve to create purchasing power out of thin air. This is a very dangerous game that becomes ever more dangerous with each passing day.

Readers of this commentary have certainly formed their own opinions on how the current financial crisis could have been avoided. Based on my own 30 plus years working in the U.S. financial services industry*, I offer these insights about the boom-to-bust nature of our economic system and what might be done to mitigate the problems as the next cycle begins. What I learned financing real estate development and affordable housing is that credit-fueled property markets are inherently unstable and are prone to collapsing every 18-20 years.

What we know is that credit acts as an accelerant, poured onto speculation-driven fires endemic to our property markets. Investors seeking high returns move financial assets from one speculative market to another: into shares of stock, into precious metals, into property, into raw land, into currencies, into mortgage-backed securities, and so on. And, of course, from the investor’s point of view, it is far better to use leverage and risk someone else’s assets in speculation than one’s own.

The use of credit by investors in the property markets is normal. What was not normal in this cycle was the aggregation of externalities — most importantly the bypassing in the United States of Fannie Mae, Freddie Mac and the FHA as the gatekeepers over the quality of collateral going into mortgage-backed securities. No objective analyst would suggest that the GSEs are blameless. However, Wall Street firms with support from the bond rating agencies approved and packaged mortgage loans originated without verification of income or employment or even creditworthiness — often with fraudulent property appraisals or no appraisal required. A high percentage of these loans was originated under predatory terms and outright fraud. The high nominal yields attracted all manner of investors in an environment absent of meaningful regulatory oversight.

What happens whenever the pool of potential borrowers or homebuyers expands as occurred in response to the explosion in the “sub-prime” business is that market forces capitalize the change in equilibrium into higher land (and total property) prices. Property prices were already increasing at dangerously high annual rates. The sub-prime market accelerated the cycle but with the added component of a greater level of criminal activity than previously experienced. As property prices climbed, Fannie Mae and Freddie Mac responded by raising maximum loan limits, reducing down payment requirements, extending mortgage terms, creating interest only mortgages, permitting negative amortization and offering adjustable rates that enabled people to qualify for larger loans. All of these steps involved elaborate risk assessment and concurrence by the private mortgage insurance providers. In the short run, these measures protected the GSEs from erosion of market share and kept stock analysts reasonably confident in profit projections.

Those of us in the industry who saw all this developing and feared the worst observed that on a growing number of property appraisals the land-to-total value ratios were dangerously high in many markets. Only a few decades ago, the purchase of a residential property required a 20 percent cash down payment. The logic of this requirement was understood. Mortgage financing was made available for the purchase of a home; cash was required for the purchase of the land parcel on which the house was constructed. As land prices escalated beginning in the 1960s, fewer and fewer households were able to meet the traditional down payment requirement. The industry responded by accepting a lower down payment and requiring the purchase of private mortgage insurance. Here, again, market forces capitalized the increased potential pool of property purchasers into higher and higher land prices.

By the early 2000s, the loans being purchased or securitized involved financing for more and more land and less and less housing. In New York City or San Francisco, for example, the land might comprise 80 or 85 percent of the total value in parts of these regions. These very high ratios were more common in transactions involving properties already improved and where existing homes were under-improvements in markets where new construction was almost universally priced beyond loan limits for the conventional market.

Development firms have long employed a number of strategies to overcome high land acquisition costs. Those with sufficient cash reserves acquire land at the margins of existing communities, holding the land until demand for new housing units materializes. Or, they will attempt to secure approval to increase densities or build upward. At the level of the individual firm these strategies make sense; however, a far more effective societal strategy would be to tame our land markets so that developers are not required to tie up financial assets in land-banking operations.

What is clear is that at some point escalating land prices impose unmanageable financial stress on businesses and residential property owners. At the peak of the land market cycle, the stress triggers a collapse in property markets (with bank failures, business failures and foreclosures as collateral damage).

As land prices increase business profit margins are reduced by rising land acquisition costs (pushed forward as increases in the cost of leasing space in office buildings, retail shopping centers, etc.). So, businesses look for ways to reduce costs of doing business. When business relocations begin and vacancy rates increase, this is a clear indication that a crash in the property market is on the horizon.

In the residential property markets, the end comes when property (i.e., land) prices become too high for first-time homebuyers to enter the market even with the exotic mortgage offerings provided by lenders. By 2004-2005, the capacity of millions of U.S. households to carry housing debt on top of other debt and expenses had reached its limit. Household incomes were stagnant or declining, household savings had disappeared for many, and interest rates were as low as they could go. To those dependent for their incomes on maintaining a high rate of property turnover, the temptation to engage in fraudulent practices was difficult to resist.

It is too late to prevent the collapse, of course. At best, actions by governments around the globe have served to create an illusion of stability by injecting huge amounts of new credit into the financial system. Serious cracks in the system have developed on the European continent, serving to divert attention from the skyrocketing debt taken on by the United States government.

The land market cycle will begin again when businesses see the opportunity to invest (to borrow and invest) in the expansion of their production facilities and begin to lease space in available buildings. As vacancy rates decline, the owners of quality buildings will quickly seek to convert rising demand into higher charges for space. Gradually, the asking price for land parcels will begin to climb and speculators will again be attracted to the land market in search of quick and above-market asset price gains. Even now, with land prices down in many markets, many investors (including foreign investors) with adequate cash reserves are acquiring land from financially distressed owners with no plans for development, waiting for land prices to recover to flip the property for what we allow to be treated as a “capital gain.” One of the real problems with our system of taxation with respect to the impact of the real economy (i.e., the production of goods) is the treatment of gains on financial transactions as more beneficial than income earned by producing goods or providing useful services. Actual capital goods depreciate in value over time and rarely sell at a price above initial cost.

Among the numerous reforms we need is regulation that prohibits banks and any other financial institution that accepts government insured deposits or other guarantees from extending credit for the purchase and/or refinancing of land. This will require investors and homeowners to come up with cash down payments from savings or other sources that do not put the financial system at risk. Removing credit as the accelerant for land speculation will not solve the problem – this requires significant changes in how government raises its revenue — but it is an important first step.

The long term solution is to remove from land markets the potential for profit from land hoarding and land speculation. The only effective way to achieve that objective is to impose an annual tax approaching 100 percent of the potential annual rental value of all types of land: land parcels in our cities and towns, natural resource-laden lands, the broadcast spectrum, rights of way granted to private entities, takeoff and landing slots at airports, and what economists describe as other forms of “natural monopolies.”

In summary, the only effective solution to the boom-to-bust nature of our economy is to tame the nation’s land markets. And the only effective means of taming our land markets are the measures I describe above. The question is whether our civic, business, labor and government leaders can come together to embrace and work for the changes we really need.

______

* I retired in 2005 from Fannie Mae, where I held positions as a manager of credit risk, and later as a market analyst and business manager in the Housing and Community Development group. Prior to joining Fannie Mae in 1984 I managed the residential mortgage loan program for a regional bank in Philadelphia. Today, I teach political economy to seniors at the O

A Dialogue on Political Economy

by Edward J. Dodson

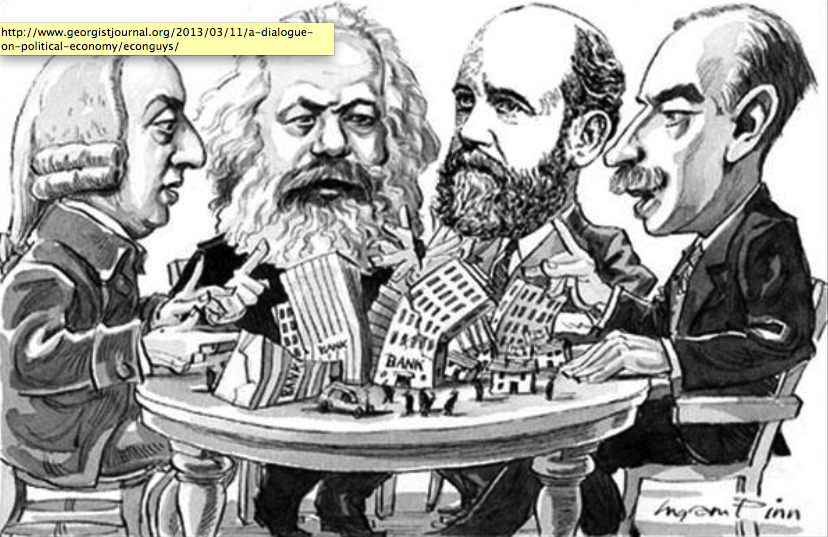

A dialogue involving several participants based on the writings of important contributors to the dialogue on the land question and economic justice, held in 1982 at the Henry George Institute, New York

MODERATOR: Welcome to this roundtable discussion on the subject of political economy. Our guests include some well-respected authorities on political economy and spokesmen for certain particular points of view where policies, prescriptions and issues are concerned. With us today are Robert L. Heilbroner, Adam Smith, Karl Marx, Henry George, Lester C. Thurow, John Maynard Keynes, Gunnar Myrdal, C. Lowell Harris, Arthur Laffer and (although he represents more of a political than economic perspective), former President of the United States, John Adams.

I would like to begin our discussion by asking Professor Heilbroner to comment on what has been a very long and unsuccessful search for solutions he has himself termed “the Economic Problem.” Professor Heilbroner?

ROBERT HEILBRONER: Thank you. As a starting point to this discussion, I would suggest to my colleagues that the trouble with economics is that it will not stand still. Issues change, ideas change, understanding changes. Even the past does not look exactly the same from one year to the next, and the present is apt to alter almost out of all recognition.

MODERATOR: How, then, Professor Heilbroner, is one to approach the study of political economy in a manner which has a reasonable opportunity to produce understanding?

ROBERT HEILBRONER: I would emphasize a broad understanding of economic history — not, of course, to learn names and dates, but to gain a sense of the evolution of the economic system, of the internal changes that have gradually altered the setting of economic life, and of the trajectory of economic evolution.

MODERATOR: I believe any of your colleagues would agree about on the importance of understanding economic history. It strikes me that the first significant changes occurred during that time period when the last remnants of feudalism in the European-centered economy were losing ground to the merchants of the nation-states and “capitalism.” Economic historians have pointed to the 16th century for evidence of this process of change. Do you see this period, Professor Heilbroner, as a period of major change?

ROBERT HEILBRONER: Yes, of course. Let me address for a moment these issues of historical change and the growth in the role of government. In antiquity and feudal times one could not easily separate the economic motivations or even the economic actions of the great mass of men from the normal round of existence itself. The peasant following his memorial ways was hardly conscious of acting according to “economic” motivations; indeed, he did not: he heeded the orders of his lord or the dictates of custom. Nor was the lord himself economically oriented. His interests were military or political or religious, and not basically oriented toward the idea of man or increase. The making of money was a tangential rather than a central concern of ancient or medieval existence.

One further comment, if I may. An essential part of the evolution of the market society was thus not only the monetization of life but the mobilization of life — that is, the dissolution of ties of place and station which were the very cement of feudal existence. And this essential requirement of mobility lends to a further point. Mobility meant that any job or activity was now open to all comers. Competition appeared. Now any worker and any employer could be displaced form his task by a competitor who would do the job more cheaply.

MODERATOR: Gentlemen, Professor Heilbroner has presented several rather direct statements concerning the development of political economy as an historical process. I’d like to first ask our Scottish colleague, Adam Smith, how his analysis of these historical processes compares with those of Professor Heilbroner.

ADAM SMITH: What Professor Heilbroner seems to be saying, without really saying it, is something about the nature of man and the nature of political economy with which I can agree. Approaching the historical evolution of the subject somewhat differently, I would spread the science of economics into two general divisions, which may be named natural economics and political economics. Let me explain what I mean by this separation. The first observes and records the behavior of the human race in obtaining its sustenance, as it could reasonably be expected when not interfered with nor diverted by any outside force. This, however, is a state which does not actually exist anywhere in the civilized world. The organization of a civilized society supposes some impairment of individual rights, and some restraint of natural individual

impulses and desires. Until human nature becomes perfect, such restraints are necessary; the problem is to keep them within the narrowest possible limits.

MODERATOR: That problem, Professor Smith, has remained largely unresolved even to the present day. This argument over the proper role of the “state” in the political economy is one of crucial importance. Your ideas, Professor Smith lie at one end of the theoretical spectrum; at the other, perhaps, are those of Karl Marx. Herr Marx, how do you view the question of individual rights, the power of the state and what best responds to human nature?

KARL MARX: Pardon me, please, if I bypass this question for the moment. I, too, would like to comment on the historical processes involved in the evolution of human society. I would simply add, here, that even when a society has got upon the right track for the discovery of the natural laws of its movement it can neither clear by bold leaps, nor remove by legal enactments, the obstacles offered by the successive phases of its normal development. But it can shorten and lessen the birth-pangs.

MODERATOR: What you’ve done, I believe, Herr Marx, is to move our discussion into another area of historical disagreement where the study of political economy is concerned. You seem to have equated change with progress. One of your contemporaries, Mr. Henry George, attempted to distinguish between these two concepts. Mr. George, how would you react to Herr Marx on this issue?

HENRY GEORGE: Time passes, changes occur, but has progress really resulted? By simple observation, I recognized that wealth had been greatly increased, and that the average of comfort, leisure, and refinement had been raised; however, it was true then and is true today that these gains are not general. The lowest class do not share in them. The tendency of what we call material progress is in nowise to improve the condition of the lowest class in the essentials of healthy, happy human life. The new forces, elevating in their nature though they be, do not act upon the social fabric from underneath, as was for a long time hoped and believed, but strike it at the middle. It is as though an immense wedge were being forced, not underneath society, but through society. Those who are above the point of separation are elevated, but those who are below are crushed down.

MODERATOR: Does this imply, Mr. George, that like Karl Marx you also see the process ending in an inevitable struggle of one class against the other?

HENRY GEORGE: With all due respect to Herr Marx and the large following he has secured, his analysis is materially flawed because he fails to properly distinguish between ownership “classes” which are productive, and therefore advance the progress of society, and those which are nonproductive. By its very nature ownership of capital must involve production in order to generate new wealth. Ownership of land, on the other hand, requires no such ownership activity, only the growth of the community. What Professor Heilbroner terms the “economic problem” can be largely solved by giving labor a free field and its full earnings; take for the benefit of the whole community that fund which the growth of the community creates, and want and the fear of want would be gone. The progress of science, the march of invention, the diffusion of knowledge, would bring their benefits to all.

MODERATOR: So, in your opinion, Mr. George, the real struggle is not between labor and capital; rather, labor and capital are united in a bitter struggle against the landowners. Is that a fair restatement?

HENRY GEORGE: Yes, I have no objection to your summary of my comments. I would, however, like to hear Herr Marx’s response.

MODERATOR: Herr Marx?

KARL MARX: Thank you. Viewed from the present, one cannot but marvel at the improvements in the conditions now experienced by a substantial number of workers in the capitalist societies. To what can be this credited? To the generosity of capitalists? To the productivity of labor? Or, perhaps, to the organization of labor into powerful political and economic voices? Long before the period of Modern Industry, cooperation and the concentration of the instruments of labor in the hands of a few, gave rise, to great, sudden, and forcible revolutions in the modes of production, and consequentially, in the conditions of existence, and the means of employment of the rural populations. I concede to Mr. George that this contest at first took place more between the large and the small landed proprietors, than between capital and wage-labor; on the other hand, when the laborers are displaced by the instruments of labor, by sheep, horses, etc., in this case force is directly resorted to in the first instance as the prelude to the industrial revolution. The laborers are first driven from the land. Land grabbing on a great scale is the first step in creating a field for the establishment of agriculture on a great scale.

MODERATOR: What Mr. George seems to be saying, Herr Marx, is that the capitalist per se is not necessarily the culprit. Certainly, the motivations of the various competing groups during the sixteenth century were many — the struggle for power between the feudal lords and the monarchies, the conflict between Protestantism and the Pope, the formation of nation-states, the beginnings of colonialism — all played a role.

JOHN MAYNARD KEYNES: Of course the capitalist, as such, is not the culprit — nor, in my view, is the landowner, as such. Mr. George and others may not agree, but one thing we must recognize is that under the system of “Laissez-faire” and an international gold standard such as was orthodox in the latter half of the nineteenth century, there was no means open to a government whereby to mitigate economic distress at home except through the competitive struggle for markets.

Having said that, I certainly agree that the outstanding faults of the economic society in which we live are its failure to provide full employment and its arbitrary and inequitable distribution of wealth and incomes. However, it must be said that since the end of the nineteenth century significant progress towards the removal of the very great disparities of wealth and income has been achieved through the instrument of direct taxation — income tax and surtax and death duties — especially in Great Britain.

MODERATOR: You see the intervention of government through taxes on income and wealth as an appropriate approach to the distribution problem, then, Lord Keynes?

JOHN MAYNARD KEYNES: I strongly believe so.

MODERATOR: Though there may be others, I suspect one member of our group in particular may strongly disagree, Professor Arthur Laffer of the University of California, and architect of what has come to be called “supply-side” economic theory. Professor Laffer, would you care to respond to Lord Keynes?

ARTHUR LAFFER: To begin with, I strongly believe the demand side policies which had been applied in their entirety did not avert the economic collapse of the mid-1970s and in my view actually brought it about. The most damaged by the contraction were the disenfranchised members of society, including minorities, youths and the chronically disadvantaged.

MODERATOR: If the demand management policies originally developed by Lord Keynes during the “Great Depression” are inappropriate, what will work?

ARTHUR LAFFER: Basically, people don’t work to pay taxes but instead work to receive something after tax. Likewise, businesses don’t invest as a matter of social conscience but do so to make an after-tax return on their investments. It is axiomatic that when more of a good is produced its price falls. Tax rate reductions do lead to more production and if combined with a good monetary policy should reduce inflation.

HENRY GEORGE: As to the question. of taxation, the mode of taxation is, in fact, quite as important as the amount.

MODERATOR: Gentlemen, the reality of the world has been an absence among even the so-called “advanced” and industrialized societies of a political economy able to produce an adequate standard of living for all, Why do you think this is so? Yes — Professor Smith.

ADAM SMITH: Far too few of those in our profession paid much attention to the lessons taught by history. In every instance, as soon as the land of any country has all become private property, the landlords, like all other men, love to reap where they never sowed, and demand a rent even for its natural produce. The man who cultivates the land must give up to the landlord a portion of what his labor collects or produces. This constitutes the rent of land which must be included in the price of most commodities.

MODERATOR: What about those societies where private ownership of land has been eliminated, as in most of the communist-run societies?

ADAM SMITH: I’m willing to address this point; however, I’d like to hear from someone here who actually had to face the issue of private property in land as a basic political issue such as President John Adams.

JOHN ADAMS: I, too, believe that property in the soil is the natural foundation of power and authority. Three cases of soil ownership are supposable. First, if the prince own the land he will be absolute. All who cultivate the soil, holding it at this pleasure, must be subject to his will. Second, where the landed property is held by a few men the real power of the government will be in the hands of an aristocracy or nobility. Third, if the lands are held and owned by the people and prevented from drifting into one or a few hands, the true power will rest with the people, and that government will, essentially, be a Democracy, whatever it may be called. Under such a constitution the people will constitute the State.

MODERATOR: The protection of property rights was an extremely important issue behind the conflict between the American colonies and its mother country, England. Why is the private accumulation of land such an important element in the classical perspective on political economy?

HENRY GEORGE: The long-term effects are best illustrated by the constant existence of speculation where private ownership has been protected by the governing authority. Essentially, the influence of speculation in land is a great fact which cannot be ignored in any complete theory of the description of wealth in progressive countries. It is the force, evolved by material progress, which tends constantly to increase rent in a greater ratio than progress increases production, and thus constantly tends to reduce wages, not relatively, but absolutely. It is this expansive force which brings to new countries, seemingly long before their time, the social diseases of older countries.

GUNNAR MYRDAL: Thank you very much, Mr. George. Findings in a study we did on Southeast Asia in the late l960s revealed there are other factors that, by keeping down the labor productivity, together are responsible for low average incomes and low standards of life. Very low living levels decrease the amount of labor input and also the intensity and efficiency of the work actually performed on the land by the labor force. Low incomes are only the other side of low labor productivity; a vicious cycle makes poverty and low levels of living, or low labor productivity; self-generating.

Behind this unfortunate causal mechanism there is a social system of institutions and power relations, that is severely inimical to productivity, at the same time as low productivity establishes itself as the norm. And within this social system, both shaped by it and upholding it, are the ingrained attitudes of people in all classes. Among the non-physical factors that keep down labor productivity are also the primitive techniques employed in agriculture, likewise both a function of the existing social system, which deprives the tillers of both capital and incentives to greater effort, and a prop to that system.

MODERATOR: That sounds very much like a prescription for social and political upheaval, which has certainly been the experience in Southeast Asia. Professor Heilbroner, can you add anything to Gunnar Myrdal’s statement?

ROBERT HEILBRONER: In my view the prerequisite for economic progress for the underdeveloped countries today is not essentially different from what it was in Great Britain at the time of the industrial revolution, or what it was in Russia in 1917. To grow, an underdeveloped economy must build capital.

MODERATOR: How important to capital building are these social and political factors discussed by both Gunnar Myrdal and Henry George?

ROBERT HEILBRONER: Very important, obviously. How is a starving country to build capital when 80 percent of its people are scrabbling on the land for a bare subsistence? The crowding of peasants on the land has resulted in a diminution of agricultural productivity far below that of the advanced countries. Hence the abundance of peasants working in the fields obscures the fact that a smaller number of peasants, with little more capital could raise a total output just as large. By raising the productivity of the tillers of the soil, a work force can be made available for the building of roads and dams, while this “transfer” to capital building need not result in a diminution of agricultural output.

MODERATOR: Is this a realistic approach to a solution, Professor Heilbroner, when there is so much political turmoil in most of these countries?

ROBERT HEILBRONER: Understand that what I have outlined is not a formula for immediate action. In many underdeveloped lands, the countryside already crawls with unemployment, and to create overnight, a large and efficient farming operation would create an intolerable social situation. We should think of the process as a long-term blueprint which covers the course of development over many years. It shows us that the process of development takes the form of a huge internal migration from agricultural pursuits, where labor is wasted, to industrial and other pursuits, where it can yield a net contribution to the nation’s progress.

MODERATOR: The problem I see in your statement is that even in the developed, industrialized capitalist economies unemployment and underemployment remain as major problems. And, government redistributive programs have not addressed the issue of creating productive employment opportunities. Not much time remains, but I would like to hear from Lester Thurow, whose book Zero Sum Society attempts to deal with this. Professor Thurow?

LESTER THUROW: To have no government programs for redistributing income is simply to certify de facto that the existing market distribution of incomes is equitable. One way or another, we are forced to reveal our collective preferences about the “just” distribution of economic resources. As a result, one basic responsibility of government in a market economy is to create an equitable distribution of income and wealth if it has not been produced by the market.

MODERATOR: What do you see as the role of the political economist in light of the increasing dependence upon government to achieve some degree of economic justice?

LESTER THUROW: My feeling is that although modern economics springs from the search for a definition of economic justice, it has largely abandoned that search. Thus, nineteenth century economists, such as John Stuart Mill and our other historical colleagues, spent much of their time searching for the principles that would lead to a condition of equity. But by the 1940s, economists reluctantly came to the conclusion that there were no economic statements that could be made about equity.

MODERATOR: Would you agree, Mr. George, with Lester Thurow’s conclusion that equity is inapplicable as an economic concept?

HENRY GEORGE: I have written, and still believe, that the association of poverty with progress is the great enigma of our times. It is the central fact from which spring industrial, social, and political difficulties that perplex the world, and which statesmanship and philanthropy and education grapple in vain. From it come the clouds that overhang the future of the most progressive and self-reliant nations. So long as all the increased wealth which modern progress brings goes but to build up great fortunes, to increase the luxury and make sharper the contrast between the House of Have and the House of Want, progress is not real and cannot be permanent. To educate men who must be condemned to poverty, is but to make them restive; to pass on a state of most glaring social inequality and political institutions under which men are theoretically equal, is to stand a pyramid on its apex.

KARL MARX: A pyramid standing on its apex will inevitably fall

America’s Dichotomy: Advantage Versus Equality

Edward J. Dodson

When it is said that the ideal is as little government as posible, the controlling principle is liberty rather than justice. This explains the falsity of Jefferson’s maxim, that that government governs best which governs least, which is carried to absurdity in the statement by Thoreau, that that government governs best which governs not at all. The truth of the matter is that that government governs best that governs most justly, regardless of the amount of government that is required to achieve the fullest possible realization of the idea of justice — Mortimer J. Adler (The Common Sense of Politics)

The story of America in the nineteenth century is the saga of a dichotomy unraveling. Certain aspects of our political economy were providing tremendous opportunity to the individual; other elements made certain the growth of a class structure plagued by conflicts between the haves and the have nots. By the eighteenth century, Europeans (mostly English) had estab1ished small communities along the Atlantic coast and its tidewater channels. Some had come to escape religious or political persecution; most, however, came because of the opportunities free access to land provided. And yet, even at that early date the colonies of England, France and Spain experienced the establishment of clearly-defined class structures. Alongside the presence of growing individualism and participatory government there stood the exclusionary institutions of slavery and indentured servitude. Already in existence was a dramatic inequality in the distribution of wealth, which became the cause taken up by reformers during the 1830s and thereafter. America has, in fact, been the battleground on which the great struggle between individualists and statists began, and is still being fought — neither possessing a clear understanding of the fundamental issues affecting civilization. Within this struggle has been a quest for both philosophical and practical dominance over America’s politica1 economy, waged by republicans on the one hand and supremacists on the other. Participants adopted confused and divisive characteristics as groups were labeled or labeled themselves as Jeffersonians, Federalists, Whigs, Democrats, Republicans, Populists, Progressives, Fabian socialists, Social Darwinists, and so on. In the end, we were left to ask what one means by the modern terms “liberal” and “conservative.” Politics, as they say, makes strange bedfellows; and in America politics created a difficult environment for pure ideology to emerge and survive. All of that was and is America, even to this day. The day-to-day events are related to us in observations by those who experienced them and by those who have later attempted to pull it all together as history. As child is father to the man, we carry with us remnants of our forefathers’ experiences. We live by codes substantially evolved during a period of civilization thought to have been much simpler, although the conflict continues over the same fundamental issues — human rights versus positivist law; tyranny by the majority versus tyranny by the few; anarchy versus the supremacist state; the sanctity of property versus a definition of what limits there are to legitimate forms of property; the separation of church and state … and so on. Everything has changed. Nothing has changed. And so it was at the beginning of the nineteenth century, remaining largely unresolved even as our own era dawned. Amidst the chaos of an evolving political economy, we have forever searched for order and understanding. From time to time we have become exalted as we “discovered” what seemed to be the solutions to our social problems. Such “golden variables” would, we hoped, make ours the first realized expression of utopian civilization. That, in effect, was an important aspect to the intellectualization of the democratic experiment which became the United States. The nineteenth century severely tested the premises on which this experiment rested, and there are those of us who look upon the cumulative weight of change in that century as both catastrophic and inevitable. The reasoning for this conclusion is to be found in our very humanness. A number of nineteenth century writers recognized the necessity for exploring human nature as a prerequisite to unlocking the mysteries of political economy. Herbert Spencer and John Stuart Mill were instrumental in paving the way. Following in their footsteps came Henry George. “Political economy” wrote George, “seeks to trace mutual relations and to identify cause and effect. The premises from which it makes its deductions are truths which have the highest sanction; axioms which we all recognize; upon which we safely base the reasoning and actions of everyday life, and which may be reduced to the metaphysical expression of the physical law that motion seeks the line of least resistance.”[1] Examining human nature from the above perspective, George was led to the axiom “that men seek to gratify their desires with the least exertion.”[2] He then identified man’s historical efforts to gain control over nature and over other men (i.e., to monopolize) as an integral part of human motivation. To monopolize might be beneficial to the individual but to civilization as a whole monopolies could only destroy. Accordingly, George warned that the overriding concern for true republicans was to prevent monopolies from arising. Taking his thought one step further, man’s absolute dependency on access to nature for survival made the concentrated control over nature the worst of all such monopolies. Land monopoly was, then, anathema to justice and to republican society. George was only one of many intellectuals, writers and statesmen who recognized the injustices inherent in a system that countenanced monopolies and the resulting concentration of wealth, income and political power. Two perspectives, however, separated him from most of his contemporaries — his truly humanitarian belief that the earth is the birthright of all mankind, and his great confidence in the resiliency of the human spirit. George’s own words express this eloquently:

Against temptations that thus appeal to the strongest impulses of our nature, the sanctions of law and the precepts of religion can effect but little; and the wonder is, not that men are so self-seeking, but that they are not much more so. That under present circumstances men are not more grasping, more unfaithful, more selfish than they are, proves the goodness and fruitfulness of human nature, the ceaseless flow of the perennial fountains from which its moral qualities are fed.[3]

As Henry George exemplifies the highest order of thinking during the late nineteenth century, Thomas Jefferson made a similar contribution to the intellectual dialogue during his lifetime. The extent to which his world suffered from the dichotomy of progress and poverty is evidenced by the conflicts within his own intellectual and personal life. He was both spokesman for the common man and slave owner. The troubled nature of his thoughts are nowhere more apparent than when be expressed his fears for the future of republican democracy. From his Notes On The State Of Virginia in 1781 came this foreboding:

The time for fixing every essential right on a legal basis is while our rulers are honest and ourselves united. From the conclusion of this war we shall be going down hill. It will not then be necessary to resort every movement to the people for support. They will be forgotten, therefore, and their rights disregarded. They will forget themselves, but in the sole faculty of making money. …The shackles, therefore, which shall not be knocked off at the conclusion of this war, will remain on us long, will be made heavier and heavier.[4]

Thus, even as the war against England raged on, the rebellious colonists carried no torch for equality — neither equality of opportunity nor equality of condition (the basis for debate over reform in the twentieth century) were factors. Such measures would have been vehemently opposed to not only by the aristocratic and propertied class but by Americans in general. Liberty and property were the primary concerns of revolutionary Americans — and not necessarily in that order of importance. In examining our history, we must remember that the American continent bad been fought over for many centuries among its indigenous tribes. Victory in warfare bad already given tremendous territorial control to such tribal clans as the Iroquois League. Then, the first Spanish, Dutch, French and English explorers and settlers arrived, members of a civilization that bad abandoned the hunter-gatherer way of life thousands of years before. European civilization was unquestionably superior in technology and was equal of the Indians in ruthlessness and brutality in war. Consequently, the opportunity to turn back the European invasion was lost before the Indians ever seriously recognized the threat. By the end of the eighteenth century, the Indians were nearly vanquished. The first and last real effort to unite the tribes against the Europeans was made by the Shawnee chief Tecumseh early in the 19th century. His efforts were doomed to fail, not simply because of technological inferiority but also because Indian civilization was far too decentralized to be marshaled into one unified force. In the end, Tecumseh was forced into an alliance with the British against the Americans. The British withdrawal after the War of 1812 sealed the Indian fate. The westward advance would continue, heroically but inconsequentially resisted. As to the future of the Indian, Tecumseh made that clear to his followers:

What I have tried to do in uniting all Indians to stop the whites who have been pushing us back, has failed. Our cause is done. No longer raise your weapons against the Americans; it can only end in disaster for you and all your people. Make peace with them in any way you can; be loyal to them in all ways; defend them against their enemies if need be, even should those enemies be other Indians, for, hear me, my brothers, the Indians can never win against the Americans. Join them, which you and your people may survive. [5]

At most, the unresolved conflict between the Indians and Whites barely slowed conquering of the frontier. A weaker (though in many ways a more egalitarian) civilization gave way to one more adept at settled existence. And yet, there was very little that could be said about the conquerors that made for a homogeneous citizenry. Though Anglo-Saxon at the core, the nation was rapidly being populated by people of diverse heritage. Many had no experience at self-government; most came from impoverished backgrounds. The clash of cultural differences was added to other dynamics in the 19th century that caused inevitable friction and a political environment characterized by intense factiona1ism. As long as the continent’s supply of good agricultural land, fresh water and other raw materials cou1d be freely had in the unsettled frontier, American society possessed a reserve which kept poverty at bay. True, opportunity was not strictly speaking equal; however, while it might be true that in the coastal cities and areas such equal opportunity had already disappeared even by the beginning of the 19th century, one could always go west –beyond the local “margin” to a place where the best nature could offer was still obtainable without payment, to a titleholder. This was an opportunity to accumulate wealth absent in Europe for all but a very small minority. In Europe, however, rumblings were being heard. In England, Adam Smith had attacked the mercantilists and their monopolistic ways; Frenchmen such as Turgot and Quesnay, of the physiocratic school of economists, did likewise and were attempting to open up the French economy. Franklin, Jefferson and Paine were particularly influenced by both the physiocrats and Smith. Then, early in the 19th century another Englishman, David Ricardo, expanded on the groundwork of his mentors. Ricardo’s labor theory of value later found its way into Marx’s attack on capital owners, whom he targeted as the confiscators of labor-produced wealth. Ricardo’s analysis of land as a factor production and the relationship between population growth, the development of manufactures and the increase in the value of land became the basis for George’s attack on the private collection of rent (“rent” being the return to landowners for the use of land). In the struggle for dominance, Ricardo foresaw that the capitalist would EVENTUALLY lose and the landowner would win, labor’s share in the distribution of wealth always tending toward subsistence level. What the physiocrats, Smith and Ricardo failed to see (but which George witnessed firsthand) was the eventual merging of the landed and capital interests to form a politically potent new class, then the growing militancy of workers as they recognized the necessity to act collectively. The debate among historians, economists and others over the importance of the frontier and supply of free land was transmuted into political activity during the last quarter of the 19th century. Henry George, himself, ran for mayor of New York against the traditional party candidates. Among George’s converts were a number of United States congressmen, including Tom L. Johnson of Ohio who was elected mayor of Cleveland in 1901. Though not surprising, Jackson Turner Main has given an account of the period strongly supportive of George’s arguments:

When the frontier stage had ended, and society became stable, the chance to rise diminished. All the land worth owning was now occupied, and land prices rose, so that the sons of pioneers and the newcomers could not so easily improve their positions. Mobility therefore diminished as the community grew older.[6]

Nevertheless, in comparison with the Old World, the new nation presented far greater opportunity for almost all new arrivals (or at least their descendants) to eventually rise above subsistence level existence. There were, however, serious limitations imposed on advancement in social and economic status. One reason was simply that one had to pass through the established colonies before reaching the frontier. The coastal regions bad originally been settled by members of England’s middle class and its better farmers, who arrived with substantial financial resources and became the colonies’ large landholders. With them they brought other English citizens as indentured servants, and these people eventually paid their way to freedom and themselves acquired landed property. What is interesting is that African slaves and other Europeans made their way to the New World in significant numbers only rather late in the 17tb century. This occurred in part because England imposed a ban on the emigration of additional skilled artisans (the loss of whom was raising wages in England — a dangerous precedent and a challenge to the established order). Another important factor in the development of the American political economy and class structure was the early establishment of higher education. Harvard College was founded in 1636. At the time there were already between 125-150 alumni of English universities who bad settled in New England. These individuals were staunch believers in English institutions and in the mother country’s system of common law on which the concepts of property would be based. And, as Henry Stee1e Commager has observed, these transplanted Englishmen were concerned not at all with equality; rather, their sense of opportunity was limited to that dictated by an imported class structure and a narrow sense of community. One consequence was that by the beginning of the 18th century free allotments of empty land throughout the colonies ended as “older settlers and their descendants saw no reason why they should not profit by [the] flood of [Scotch and Irish] immigration by buying land cheap and selling dear.”[7] Land speculation soon became a major preoccupation of the established colonists, so that “by 1720 so much land bad been taken up … that the only recourse for a poor man who had not the wherewithal to satisfy a land speculator, was to ‘squat’ without leave on Crown or proprietary land; and to repeat the process if he were forced to move on.”[8] Thus, free access to land began to disappear long before settlement of the frontier; first the colonial legislatures and then the states had adopted the English system of property law that sanctioned the concentrated control of the nation’s land, an aspect of the new nation’s structure which Henry George and others later identified as the root cause of mass poverty and social problems. Economic rights incorporated into the republic’s new Constitution aimed at guaranteeing the preservation of property, not at the means to ensure its equitable distribution. One result was that the advantage of being born into a family of early colonial landholders remained an important determinant of social and economic position in the America of the 19th century. For, example, of “the wealthiest [100] Virginians in 1787, 79 or 80 inherited all of their wealth. These were members of the First Families — the old, established aristocracy of the colony which survived the Revolution intact.”[9] I believe it crucial, then, to ask why both the intellectual and political challengers of the status quo concentrated their attack on “capitalists” rather than on the large “landowners.”

Some insight into this enigma is provided by historian Douglas T. Miller, who observes that many historians “have made a distinction between mercantile and landholding families on the one hand and rising capitalist-industrialists on the other, imp1ying that these groups … were somehow diametrically opposed to one another.”[10] Reformers and historians would do well to give strong consideration to Miller’s conclusion that “Although all barriers between the so-called ‘old’ family rich and ‘new’ were not entirely broken down so far as the drawing room was concerned, it was no longer meaningful to speak of these precise divisions by the 1850’s.” [11] Almost without exception, the rich were rich in part because of land speculations and the monopolies secured by the use of such wealth and its inherent political power. Land monopoly begot influence and capital, which begot greater land monopo1y, which expanded opportunities for political and finance manipulation — all of which set the stage for the entrenchment of monopoly-capitalism. In response, American society was opened to the rise of reactionary philosophies and their protagonists — the union organizers, the Fabian socialists, the nativists, the protectionists and the interventionists. The acceleration of industrialization in the second half of the 19tb century created a potent environment for change, but one which contained the seeds of destruction for the Jeffersonian vision. The possibility of becoming a society of educated, bard-working yeoman farmers became a quaint dream. The frontier remained, but much of it was now controlled by absentee owners or the government. New technologies enhanced the production of many goods, reducing the unit cost of production and– theoretically — adding to the purchasing power of the wage laborer. Immigration and the freeing of blacks from slavery, on the other hand, increased the competition among such laborers for employment in industry, resulting in a reduction of money wages toward subsistence. Unemployment became an ongoing social problem. The premature enc1osure of America’s unused land put the unskilled laborer at the mercy of the “robber baron” landowner-capitalist, and made inevitable class conflict. As a consequence, a republican future characterized by the protection of individual liberty against the exercise of license by either monopolists or the State (the quest of Henry George and of those who subscribed to his reform program) failed to emerge as the preeminent challenge to the status quo. People who had never been farmers or had never owned land saw as their oppressors the factory owners and the finance manipulators. Those who were initially capitalists may have gained control of much of the unused land; however, failing to understand the connection between landed monopoly and mass unemployment, reformers chose a path that would eventually subordinate individual rights to the hoped for security of a supremacist state. Labor resorted to unionism, capital to protectionism and then secondarily to other ways of strengthening their respective monopolies. As the large landholders ventured into capital ownership and “stewardship” of the financial system, they consolidated their ability to impact the distribution of wealth in America. Reformers attacked monopoly-capitalism and put forth socialist programs as the alternative. Slowly, statist interventionism worked its way into the political system; the supremacists were, in the end, victorious over the individualists, because of the latter’s unwillingness to compromise for a fair field with no favor as opposed to unbridled liberty (i.e., the license to monopolize). With each new wave of immigration and after each recessionary period, Americans looked more and more to government to solve the problems of a political economy plagued by unequal opportunity. Real reform proved to be impossib1e in 19tb century America, as this description of the political environment by Robert Wiebe clearly shows:

The established leaders in urban-industrialized America properly believed that their opponents would destroy them, or at least their functions, if they could, just as the protectors of the community accurately sensed the existence of a league of unrestrained power. …Both then assigned the enemy a monolithic consistency and machinelike organization, invested it with a conspiratorial design, and imputed to it an almost supernatural potency. Honors for distortion divided about equally.[12]

This explains why a sincere attempt such as George’s to bring about a more humane system of politica1 economy had very little chance against the established system of industrial-landlordism or the supremacist doctrines hailed by the socialists. As Wiebe goes on to conclude, “The mediator simply could not function” and even a “well-intentioned citizen like Frederick Jackson Turner, who tried from the middle ground … to explain the radical West to the respectable East, had to a wait a saner day.”[13] Unfortunately, that day has yet to come. As a voice in the wilderness, Henry George fought on the battlefield right up until his death in 1897. That so many people in this world suffer from political oppression and unrelenting poverty should be warning enough that despite all the advances in science and technology, despite the efficiencies of mass production, despite participatory government — we have not done what we must do. George’s fundamental reform was directed toward a permanent end to land monopoly, peacefully and in an evolutionary manner through the use of government to collect the annual rental value of land for use as society’s common fund. Even then, he anticipated a long and hard struggle to secure lasting improvements in civilization:

Let me not be misunderstood. I do not say that in the recognition of the equal and unalterable right of each human being to the natural elements from which life must be supported and wants satisfied, lies the solution of all social problems. I fully recognize the fact that even after we do this, much will remain to do. We might recognize the equal rights to land, and yet tyranny and spoliation be continued. But whatever else we do, so long as we fail to recognize the equal right to the elements of nature, nothing will avail to remedy that unnatural inequality in the distribution of wealth which is fraught with so much evil and danger. Reform as we may, until we make this fundamental reform our material progress can but tend to differentiate our people into the monstrously rich and the frightfully poor. Whatever be the increase of wealth, the masses will still be ground toward the point of bare subsistence — we must still have our great criminal classes, our paupers and our tramps, men and women driven to degradation and desperation from inability to make an honest living.[14]

Somehow, throughout it all, the human spirit remains ever resilient. Perhaps we will look again at the 19tb century, to its lessons and the ideas of its clearest thinkers, for a path which will take us into the 21st century absent the problems of poverty, mass unemployment and class conflict that now plague our civilization.

REFERENCES

1. Henry George, Progress and Poverty (New York, 1879. Reprinted, Robert Schalkenbach Foundation, 1975) pp 11-12.

2. Ibid.

3. Ibid., p. 461.

4. Cited in Fawn M. Brodie, Thomas Jefferson NY: W.W. Norton & Co., 1974) p. 156.

5. Cited in Allan W. Eckert, Gateway to Empire (Boston: Little, Brown & Co., 1983) p. 689.

6. Jackson Turner Main, The Social Structure of Revolutionary America (Princeton: Princeton University Press, 1965) p. 177. NOTE: It is hard to ignore the influence on Main of his namesake, and of Henry George on Frederick Jackson Turner. Researching this connection, one historian compares George and Turner, noting that “George [predicted] that the open frontier would end before the turn of the century and with its ending would come a host of social evils if our land tenure system were not improved.” He goes on to conclude “Here was the frontier thesis of Turner right down to the key safety valve idea. …It could hardly have failed to attract Turner’s attention, and indeed, recent historical scholarship has put the matter beyond speculation. Turner’s biographer, Dr. Fulmer Mood … discovered that Turner owned a copy of Progress and Poverty and that the young historian had read and marked the book in 1888-9 while a graduate student at John Hopkins; in the same year Turner took part in a seminar discussion of the book.” (Steven B. Cord, Henry George: Dreamer or Realist? [Philadelphia: University of Pennsylvania Press, 1965] pp. 75-76.)

7. Samuel Eliot Morison and Henry Steele Commager, The Growth of the American Republic (NY: Oxford University Press, 1962) p. 104.

8. Ibid. NOTE: That land hunger becomes a factor so early in American history was a clear warning of the developing class conflicts. Absentee landlordism sent millions of Irish to their graves and to America. “In that new world which had been called into being to redress the balance of the old there was to grow up a population among whom animosity to England was a creed, whose burning resentment could never be appeased, who, possessing the long memory of Ireland, could never forget. The Irish famine was to be paid for by England at a terrible price; out of it was born Irish America.” (Cecil Woodham-Smith, The Reason Why (NY: McGraw-Hill, 1953), p.136.

9. Main, pp. 183-184.

10. Douglas T. Miller, Jacksonian Aristocracy, (NY: Oxford University Press, 1967) p. 124.

11. Ibid., 127.

12. Robert H. Wiebe, The Search for Order 1877-1920 (NY: Hill and Wang, 1967), p.96

13. Ibid., 97.

14. Henry George, Social Problems (NY: 1883. Reprinted by the Robert Schalkenbach Foundation, 1966), p.201

A Debate Over Monetary Reform

Edward J. Dodson

[The following is a partial transcript of an online Land-Theory discussion that occurred at the end of June 2003]

MASE GAFFNEY: One hazard that our present ways have created is the use of land value as collateral for bank loans, and the dependence of the money supply on bank loans. Our monetary theorists should go to work on that one – it is a big subject.

FRED FOLDVARY: Some Austrian-school theorists are on the cutting edge of such studies. They show the faults of central banking and fiat money, and analyse the remedy, free banking (free-market banking with no central bank), and commodity-based money.

STEPHEN ZARLENGA: Fred, those are assertions in praise of your fellow “Austrians,” but in my viewpoint, the only thing that such theorists are on the “cutting edge” of is a giant leap backward, and I give five reasons why, summarized in the George study, taken from Chapter 16 of my new book, The Lost Science of Money.

ED DODSON: Mase is, in my opinion, exactly correct about the use of land value as collateral for bank loans. Bankers are frequently lulled into a false sense of security by the upward movement of land prices. This is a very serious problem, still, with regard to construction loans made to developers, when the banks rely on appraisals rather than a conservative forecast of cash flows coming from the property. After the last round of bank failures in the late 1980s, the regulators finally imposed some restriction on how much a bank could lend toward site acquisition (as I recall, it is 65% of the appraised value of the site, which still means that the risk is fairly high). In the realm of residential lending, private mortgage insurance companies take the top exposure to losses and the homeowner/mortgagor pays an annual premium to the insurance company. As the cash contribution requirements and reserves after closing requirements have been reduced, the premium charges have increased. At the same time, the use of sophisticated credit risk models fed by huge amounts of performance data have resulted in fewer and fewer losses associated with defaults. It should be said, however, that we have not endured a prolonged and deeply-penetrating recession here in the U.S., which would certainly test the stability of the finance system.

*******

FRED FOLDVARY: With free banking, private banks issue money substitutes in the form of paper notes or bank accounts, convertible into base money, and issued only to the extent that the public desires to hold such money substitutes.

STEPHEN ZARLENGA: By this point Fred, you have gone against several of George’s major monetary positions including his continually stressed position to distinguish money from wealth; his pointed distinguishing of money from credit; his well informed condemnation of the “free banking” of his day; and his abhorrence of granting special privileges to bankers (or others). All these are part and parcel of what is called “free banking,” which is not to say that free banking has been properly defined. Your short description is fine to identify it in an email, and readers may believe that it is consistently defined in substantial detail elsewhere, but I have found (one of the 5 points) that the free bankers have not consistently defined either free banking, or money.

ED DODSON: The key question of law is whether banks must hold or hold claim to whatever good or basket of goods is accepted as “money.” The strongest argument against banks of deposit holding precious metals is that this removes these precious metals from exchange and use in the production of goods. Precious metals are recognized and accepted globally as a storehouse of value; however, there is no reason why a bank of deposit could not acquire precious metals and then lend those precious metals out to producers, who would be contractually obligated to return the precious metals at some future date (plus a user charge). The collateral for the loan of this money could be other assets of equal value, an assignment of cash flows, or the assets of an insurance company that issues a policy to the borrower. What the law should not permit a bank of deposit to do is issue general obligation notes (i.e., uncollateralized debt) as a money substitute. When a bank of deposit makes a loan to a borrower, the bank is transferring the exchange value of a specific quantity of precious metals to the recipient. Subject to appropriate oversight by the insurance industry, by shareholder appointed auditors and by government regulators, there is no reason why there cannot be numerous banks of deposit operating safely and soundly under these conditions. This would constitute a system of private banking that eliminates the problem of the self-creation of credit (i.e., the printing of promissory notes backed by nothing in particular).

*******

FRED FOLDVARY: In my analysis, there is no way to reform central banking. It is inherently faulty and creates more instability than it cures. We need to replace it with free banking, which would include local currencies, LETS (local exchange trading systems), etc.

STEPHEN ZARLENGA: It was for good reasons that we began moving away from free banking 175 years ago, and George gives a number of them as cited in the George paper. Henry George was pretty familiar with types of LETS plans – he even set one up in an emergency for his friend Tom Johnson. But he never viewed it as more than a temporary crisis remedy. On the other hand he did favor a centrally controlled monetary system, but emphatically, controlled by government not under private control. As my paper on Henry George’s Concept of Money notes, George was an informed and lifelong supporter of the Greenback system. “I’m a Greenbacker but not a fool!” he once remarked (citations in the study).

ED DODSON: All around the globe today there are currency-starved communities. The situation is getting worse because less and less is produced locally that is exchanged locally. Thus, the currency or bank balance equivalent is not deposited in the same community in which purchases of goods are made. The purchasing power continually leaves these communities to be deposited into corporate accounts and distributed to executives and employees at some other part of the globe. LETS plans are critical alternatives that encourage local exchanges — keeping purchasing power circulation locally. I go further than Fred has in his comment above. The link between central banks and government treasury departments amounts to the legal authority to issue counterfeit money substitutes. When the U.S. Treasury issues bonds, the only legitimate source of investors ought to be holders of currency and/or bank balances that are fully backed by some basket of commodities or precious metals. The situation today is that if Alan Greenspan believes that printing more Federal Reserve Notes to give to the U.S. Treasury in exchange for bonds will not cause too much of a depreciation in the exchange value of these Federal Reserve Notes, there is nothing to prevent the Fed from doing so.

*******

FRED FOLDVARY: The three great economic reforms need to be the public collection of rent, free trade, and free banking.