Introduction and Current Release Notes:

The Land Value calculator was first released in 2020 by the Henry George School of Science. The tool allows users to calculate the Land Value tax rates of over 3,000 counties in the US. This simple tool enables users to put theory into practice for various applications. To keep the calculator as accurate as possible, we occasionally update and refresh the underlying data.

The LVT Calculator has been refined with the most recent data, incorporating the 2022 Version 3.0 of county land value data from the Federal Housing Finance Agency and the State level average land valuation report from Morris (2022). The updates include refreshed state-level averages and updated county-specific land values, with an increase of 90 in the number of counties with specific values. In addition, the New York City data was adjusted by substituting NYC Kings County as a proxy for New York County (Manhattan) which was not included in the FHFA data.

FAQ:

Release history: Version 1 of the Land Value Tax Calculator was released in March of 2020. Our newest update, Version 2, was released in 2023, and includes data on 3,146 counties covering the entire 50 US States. State average land values have been updated for all counties across all states from Morris (2022). The calculator now includes specific land values for an additional 90 counties, increasing the total number of counties with custom data values from 964 to 1,054. A total of 958 counties have received updated land values specific to the county itself, which represents a full 30% of all counties listed in the Census Tract report. For New York City, Manhattan (New York County) was not provided in the FHFA data listing, but the specific land value for Brooklyn (Kings County) was substituted as a proxy to match the values more closely. The LVT Calculator automatically chooses specific values for the tax computation when available instead of the State average.

Updated Sources: The LVT Calculator has been updated to include new data sources. The data sources used in the new version are Larson (2022) and Larson (2019) from the FHFA, as well as a State average from Morris (2022). The default county land value is now the State average for all counties from Morris (2022), while all updated counties will draw from Larson (2022). For counties that have not been updated, but have specific land values, the calculator will draw on Larson (2019). These changes have been made to ensure more accurate tax computation in the LVT Calculator.

Q: What is the purpose of the Land Value Calculator (LVC) Tool?

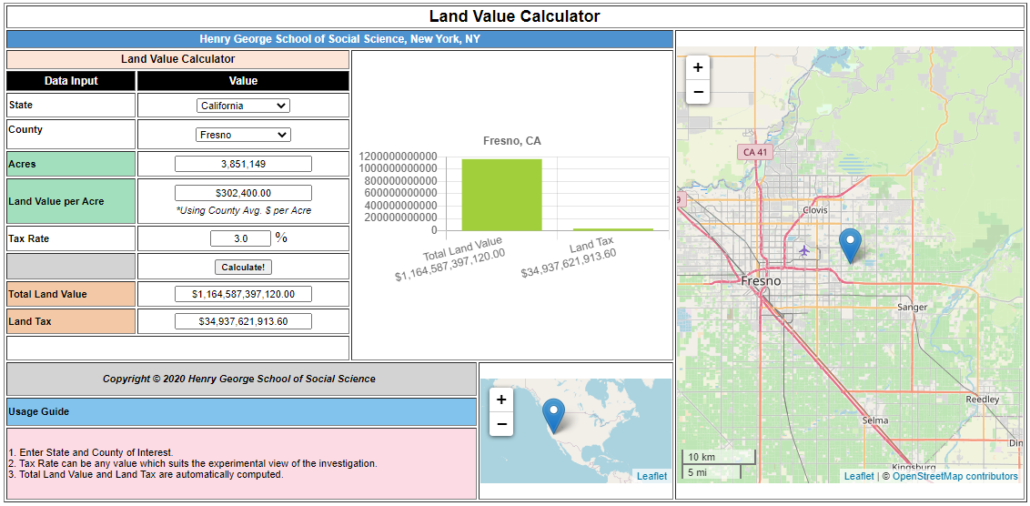

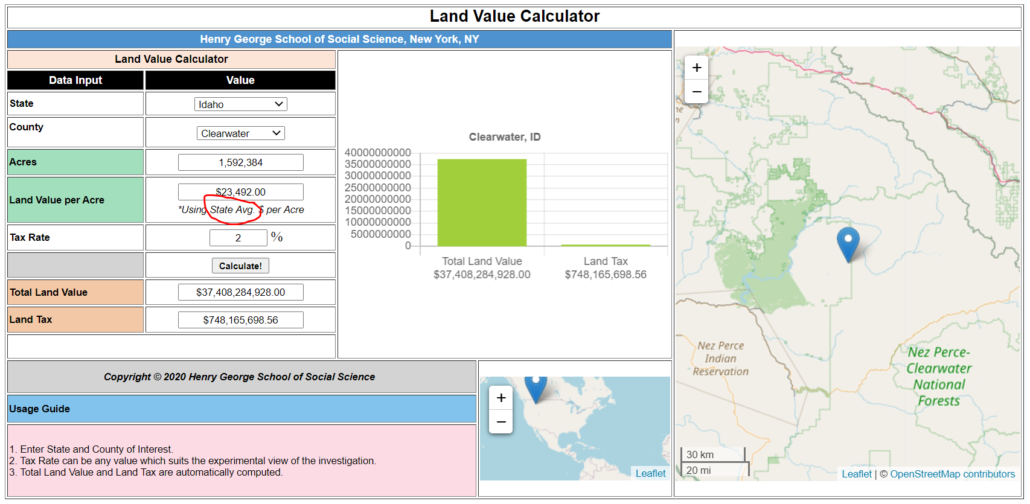

A: The LVC is designed to help researchers, policy makers, educators, and students to explore and understand the relationship between land dimensions expressed in acres and land value. Additionally, the tool allows for the dynamic exploration of varying tax rates to determine target Land Tax values. The tool also graphs this data and provides adjustable mapping information. See Figure 1 for an example of a completed scenario for Fresno County in California.

Figure 1 – Scenario 1 Fresno County

Q: How do I get started using the tool?

A: To use the tool there are only a few basic steps:

- The initial start page will not display any data. Simply begin by selecting the State of interest from the drop down for the study or investigation.

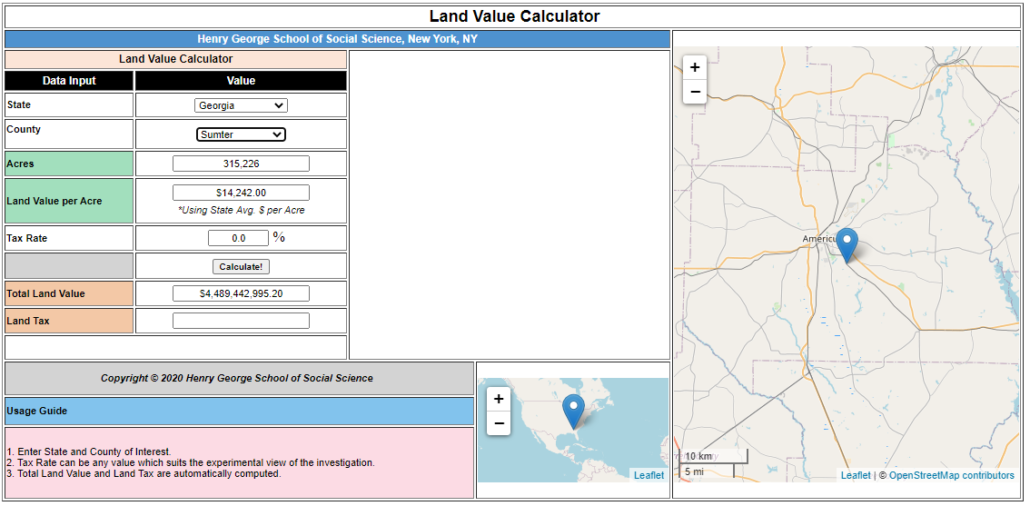

- Next, select a County from the drop down. Upon doing so the “Acres”, “Land Value per Acre”, and “Total Land Value” fields will be auto-filled. See Figure 2.

Figure 2 – Scenario 2 – Initial steps to filling in the form

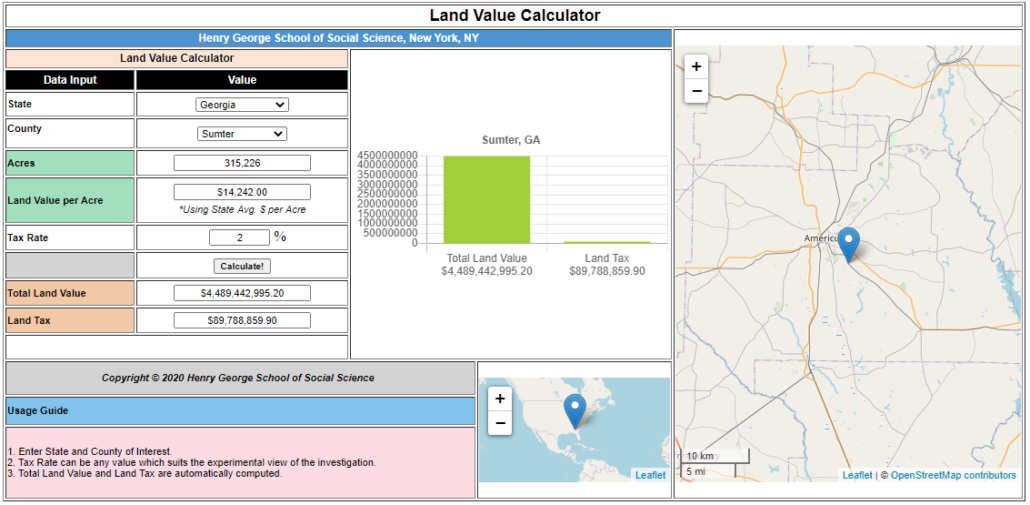

Q: What is the final step to calculating the Land Tax?

A: To calculate the “Land Tax” at the bottom of the form simply enter the “Tax Rate” percentage in the middle of the form. You can actually enter any figure you like. This allows you to experiment with the Tax Rate which will produce different Land Tax levels. The results will be displayed in the bar graph in the middle of the screen. See Figure 3. In this case at a 2% tax rate the Land Tax yields $89M for the county. Currently in 2020 Sumter county collects $9M in taxes. Clearly an exceedingly small Land Tax could cover the County tax needs. In all likelihood such a small tax level might cover all government revenue needs for all municipalities as well.

Figure 3 – Scenario 3 – Completing the Land Tax Calculation for Sumter County Georgia

Q: Where did the idea of a Land Tax come from?

A: Henry George, the 19th Century Economist, believed that a single tax on land value which would replace all other taxes could meet the needs of society in a more equitable manner. In essence, George believed that society could recapture the value of its common inheritance, raise wages, improve land use, and eliminate the need for taxes on productive activity by this method. This approach is diametrically opposed to the income tax, wealth tax, and tariff-based tax models in place today. During his peak of popularity at the end of the 19th Century George had a wide following in the US and abroad. Even today some governments have implemented such a model to significant advantage most notably Hong Kong and Singapore. Unfortunately, the land value tax did not maintain enthusiasm in the US during the 20th Century and in fact neo-classical economics which dominates both academia and public policy spheres reclassifies land as capital which distinguishes it from classical economics. Such a conflation of land and capital introduces a less accurate understanding of underlying economic value.

Q: Why is a Land Value Tax Calculator needed?

A: This interactive tax calculator can be used to explore tax rates for specific regions in the US. This model can then help understand if a tax on land values alone would meet the appropriate funding needs of that jurisdiction and to what level these taxes would have to be set to do so. The calculator provided here allows users to understand a wider set of issues by exploring entire counties and jurisdictions and then allows for comparisons against macro governmental budgets.

Q: What was the motivation for creating this calculator?

A: In addition to allowing users to better understand the Land Value Tax concept and to visualize its impacts another goal was to allow users to compare LVT results with other tax outcomes. For example, this user-friendly calculator allows modeling of tax scenarios for all 3,100+ counties in the US and can be contrasted with tax computations such as the Wealth Tax Model of Saez and Zucman. Doing so will provide clear demonstration of the benefits of a LVT over a Wealth Tax. Further, this LVT calculator can be used for understanding policy making needs and for conducting research or developing education programs.

Q: Where does the land value data come from in the Calculator?

A: The data driving the Land Tax Calculator are primarily from several sets of data:

Larson, William, ed., “The Price of Residential Land for Counties, ZIP Codes, and Census Tracts in the United States”, A FHFA Working Paper 19-01, Federal Housing Finance Agency, Version 3.0, October 2022.

Larson, William, ed., “The Price of Residential Land for Counties, ZIP Codes, and Census Tracts in the United States”, A FHFA Working Paper 19-01, Federal Housing Finance Agency, Version 1.0, January 2019.

Kathy Morris. “How Much An Acre Of Land Costs In Each State” Zippia.com. Aug. 16, 2022.

Specific supporting research sources as noted in the references section as required to support jurisdictional budget data;. (For details see: Cusick, James, “Exploring a Land Tax Approach with an Online Calculator”, November 2019, DOI: 10.13140/RG.2.2.16296.11523/2). The primary county land value data is derived from an assessed value approach provide by the Federal Housing Finance Agency. Effectively, the methodology of this analysis includes land values on a per-acre basis which are then “spatially interpolated to the universe of single-family homes.” From this result the average observed value is further interpolated to a per-acre land value across all units within the county. This results in the skewing of the values to some extent as the weighting is towards this mix of data. However, as this is evenly applied throughout the country it does provide a useful base for exploration of values.

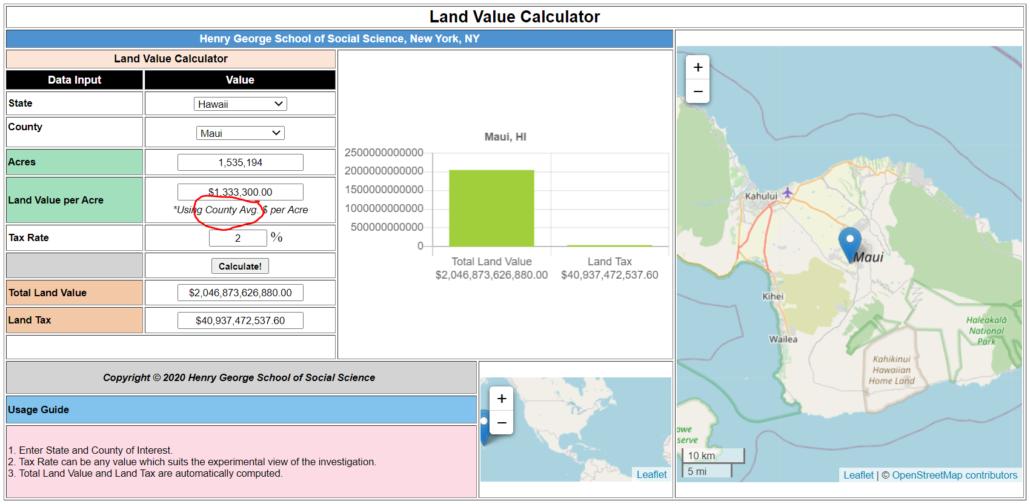

Q: Why are some counties shown with “State Average” and some with “County Average”?

A: Of the 3,146 Counties available in the Land Tax Calculator, a full 964 have County specific land values associated with them. For those cases the interface will note “Using County Avg.” as in Figure 4. When no County specific land value is available the user will see “Using State Avg” in the Land Value per Acre field as in Figure 5.

Figure 4 – County Average Example – Maui, Hawaii

Figure 5 – State Average Example – Clearwater, Idaho