When Workingmen Shook the World – the 1886 NYC Mayor’s Race

Mon, December 21, 2020 | 6:30 PM – 8:00 PM EST

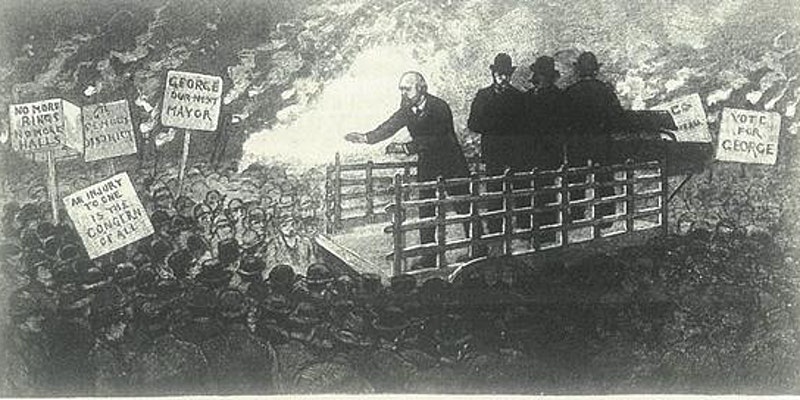

In this webinar, Dr. Marty Rowland will present an in-depth look at the 1886 NYC Mayor’s race which featured Henry George as the workingman’s candidate versus Congressman and social elite/politically connected Abram S. Hewitt. Three levels of analysis will be explored:

a) Institutional and 19th century corrupt practices of NYC politics that roadblocked the possibility of George’s win;

b) How hopes of a NYS and National Labor Party were dashed in the 12 months following the 1886 election; and

c) Lessons still relevant for advancing George’s Single Tax within today’s socially progressive movement.

Dr. Rowland is a Henry George scholar and Trustee of the HGSSS, a licensed professional environmental engineer, natural resource economist in the tradition of George-Ostrom-Bromley-Raworth.

A link to join the online seminar will be provided via email before the start of the webinar.