A Different Type of Land Value Tax In the Republic of Ireland

Once Ireland was a rural and poverty-stricken land. Hundreds of years of British rule by a landed aristocracy sucked rent, food, and money out of the nation.

Independence came, but not a lot changed. Then the EU happened. Traditional markets expanded, and a rock-bottom corporate tax rate of 12.5% sucked investment capital and New Economy labor in. But, like a heady froth of Murphy’s Stout, it went flat as all bubbles do. Overbuilding and private land banking put urban and inner ring land out of reach for most, just as inflow immigration soared.

Last year, calmer and more independent minds started to prevail, and some “Engulf and Devour” corporations were bumped up to 15%, which is still a pretty sweet deal.

That sets the table for recent and promising developments. The Irish government still realizes that land prices make it very difficult for people at all income levels to find proper shelter at a reasonable price. The tax system, however, is more a hindrance than a help. The local property tax is a good concept and despite complaints from taxpayers is the most reliable of revenues for governments. Still, in Ireland property valuation has a very light touch, including self-assessment for tax purposes. Disagreements about the self-assessment would end up in the courts and bog down the system.

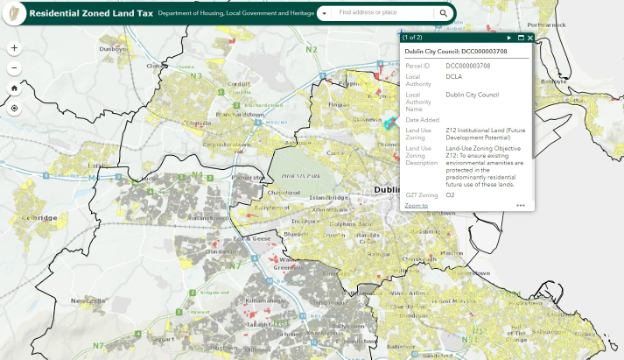

On a positive note, The Residential Zoned Land Tax (RZLT) finally comes into effect in 2024. Valuations were produced for 2022, giving landowners ample time to grieve their assessment. RZLT is deferred when construction is deemed to be complete.

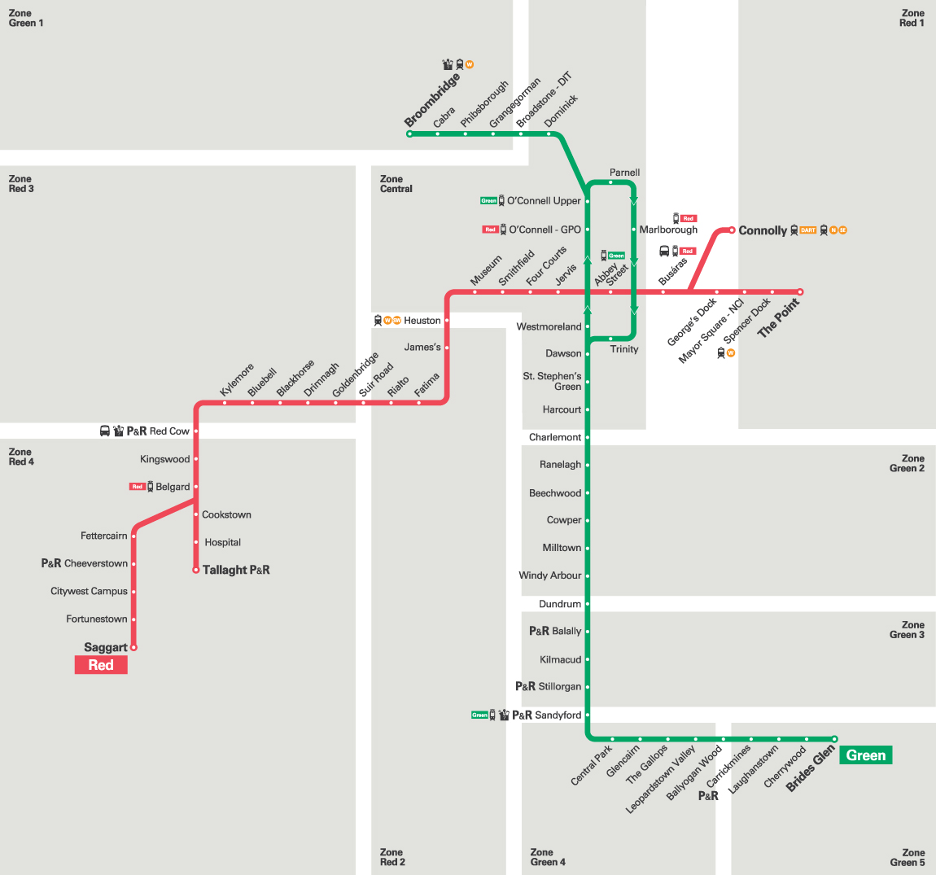

The rationale for the law is commendable: if you own the land improved by adjacent infrastructure (witness the land value increase on the LUAS line) through no action of your own, then you owe the government some money. Even more admirable is the 3% tax on the land’s value. In a country straining to make space for people where development is wanted, re-zoning of land results in higher land values. That land value is leverage for the community to get things done.

Where the LUAS goes land values follow

In preparation for RZLT, online maps cover the entire country. As many of our readers know maps cut through the fog of tax policy to illustrate the importance and relevance of land topeople’s lives.

It is undoubtedly a good policy shift, but more work needs to be done. For example, a straightforward land value tax (LVT) has been bandied about by all the right people since the 19th century but blocked by all the wrong people since then. Yet there is still an LVT discussion in Ireland in the press and government. This white paper is evidently meant to be secret, but there it is.

Stay tuned, as the Irish Dail is currently debating the Impending RZLT and pondering the way forward.

David is a genius.

Henry George would say “why didn’t I think of that?”:

A More Stealthy Georgist Cat By David Harold Chester, October 2019

The Georgist cat is small and lean

And often doesn’t get to be seen.

It hides in the branches of an economic’s-tree

So it takes a long while for you or for me,

To appreciate its cute and original form

That the landlords are so ready to scorn.

The economic’s-tree has many fine branches

(On which we contend, there are no free-lunches).

Whilst the land-owning rich in the city all claim

As bloated capitalists, that they’re not to blame

For the gap that lays ‘twixt the poor and the wealthy,

But oppose any tax to make our nation healthy.

Have you heard the tale of a committee, that

Thought to bell and get warning of a fat cat?

But could not find a soul to apply this device,

Because typically all were a council of mice!

Our Georgist cat has a bell ready-fitted,

(Which makes this analogy more to be pitted).

This warning sound makes our ideals unwanted,

For a new tax is how politicians get doubted.

So the Georgist cat fails to catch any mice

That pose as landlords, along with their vice.

But how shall we silence the bell’s warning sound

And quieten the news that our pussy’s around?

Our Georgist feline is in serious error,

‘Cause its bell draws attention not only to whether

Valuable sites can be ethically shared,

But also the rent from a site is declared

As the means to replace other kinds of taxation,

Which obviously causes the landlords vexation.

In the economic’s tree many other beasts lurk

But are missed, after learning of Henry G’s quirk

Through the cat-finder’s recently brilliant discovery.

This writer seeks a new means for recovery

From our politi-unacceptable claim,

And stealthily project LVT once again.

If we would but examine some more of the tree

Alternatives are waiting there for us to see.

Among them is hiding a far better way

For an equivalent LVT effect, to stay

In essence, without causing such evil offences

To the landlords and their partitioning fences.

When a property-owner decides to sell–quick

The gov’ment buys its land, and not the public!

Its occupant then leases it for a similar fee

To the One-Tax of Henry George’s decree.

Any buildings on-site should be sold as previously

But without the land, on which the price grievously

Had risen, with huge speculation in its advance

That stopped entrepreneurs from having a chance.

The cost of this land must be raised through new bonds

Which the government sells and the public responds,

‘Though their interest-rate’s a bit lower than rent,

Their returns are more stable than the average tenant!

This process will take many years to complete–

So its financial support is no great money feat.

After the lease-fees begin to collect,

Gov’ments can tax less, and firmly expect

To pursue this policy without change, until

All the lease-fees are site-rents in the national till.

With the land properly shared, the government sees

That site development stays with the current lessees.

Other taxes that cause so much trouble and hate

Are scrapped, with great pleasure to all in the state,

Except for some bankers and the tax collectors

Whose actions no longer apply in these sectors.

Land-rights will be shared through this simple device,

By a fast-growing country that takes our advice.

If the Irish government could be persuaded to a) purchase the useful site of land as they come up for sale, (whilst their :improvements” or buildings etc. would be sold in the normal way, when applicable), and then b) take the newly nationalized rent from the land occupier as an annual lease-fee, then c) the speculation in land values would slowly cease and the equality of opportunity for entrepreneurs to make proper use of the resulting vacant sites would follow, and d) this would allow the previously associated poverty (due to poor working opportunities) to gradually be eliminated.