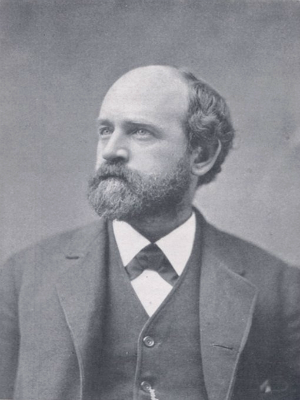

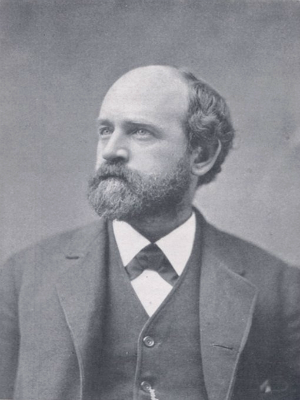

In the aftermath of the economically disastrous long depression of the 1870s, a California journalist named Henry George studied a distinctive dilemma of modern capitalism: the fact that progress seemed to deepen social inequality and economic instability. The result was Progress and Poverty (1879), a book that challenged widely accepted doctrines of property rights and laissez-faire. This surprising bestseller changed the way many people thought about and understood political economy.

Henry George proposed a simple solution to the problems of economic inequality and industrial depression. In contrast to others of his era, George singled out one of the most cherished institutions of liberal capitalist societies: private property in land. He called for replacing all federal, state, and local taxes with one tax on the full value of land—the “Single Tax”.

Neither a property tax nor a land tax, the single tax only applied to the socially created value of land. George understood that land values increase as a result of the location of land near schools, hospitals, businesses, and the like. Taxing only land values, he believed, would generate all the revenue needed to operate government and produce greater levels of opportunity.

His proposal became known as “the Single Tax” and those who supported it were called “Single Taxers”. The Henry George School of Social Science was founded to educate people about this visionary philosophy and how it continues to resonate from 1879 to the economics of today.

Read Progress and Poverty.

Visit the Archives of Henry George to learn more.