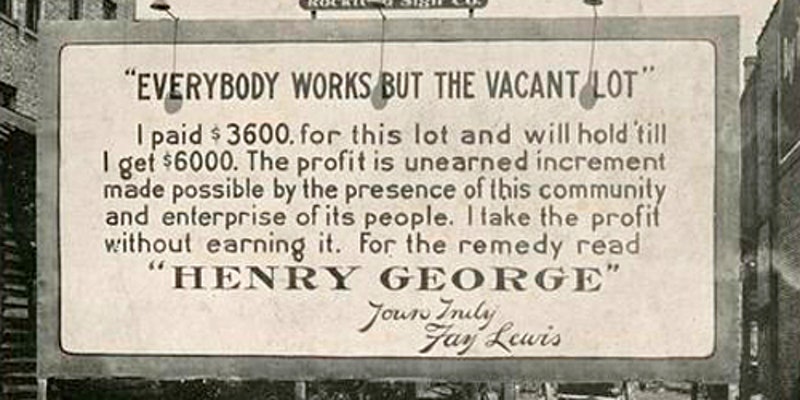

George’s Quest for a National Single Tax: The Land Value Income Tax (LVIT)

In less than two years after Henry George first began publishing his weekly newspaper The Standard in January 1887, he begins recording a drive (in November 1888) to replace state-wide enforcement of the single tax with a uniform national single tax governed by Congress. This series of lectures and discussions chronicles that national drive from its inception, until after the 16th Amendment is ratified in 1913, which is when the national movement and the land value income tax (LVIT) should’ve resumed, after a major setback caused by the Supreme Court in 1895, but never did.

Session 1: Formation of the National Movement

Wednesday, February 17, 2021

• National Enrollment Committee

• First National Single Tax Conference

• Platform of the Single Tax League of the United States

• Required Adoption of the Platform

Session 2: Shearman Proposes “A Just and Practicable Income Tax” to the 53th Congress

Wednesday, February 24, 2021

• Final Months of The Standard

• Unauthorized Alteration of the 1890 Platform

• Ways and Means Subcommittee on Internal Revenue

• The LVIT is Law for 7 Months, Then Ruled Unconstitutional

Session 3: Shearman’s Temporary Return to the Statewide LVT Becomes Georgism’s Permanent Solution

Wednesday, March 3, 2021

• Shearman’s Response to the Ruling in Pollock v. Farmers’ Loan (1895)

• A Fully Restored 1890 Platform Starts an Effort to Return to the National Campaign

• Louis Post and Joseph Fels Try to Restore the LVIT after Ratification of the 16th Amendment

• The Four Modern Land-Gain Income Taxes that Remain Relevant Today

The instructor: Richard DiMare is a graduate of Boston College and the Massachusetts School of Law, and has been a licensed Massachusetts attorney since 2006. He is interested in only one area of law, that which helps wage-earners, both white and blue-collar, to claim a property right in their wages, thus beginning the long-overdue process of shifting the tax burden away from wages and onto unearned incomes and large estates. Richard’s interest in this area of law likely developed from his background in the commercial fishing and seafood industries, witnessing many workers fighting for survival wages, then being taxed on those wages, while passive receivers of unearned incomes were increasingly under-taxed, or not taxed at all.