Join us for a panel discussion on how grass-root organized resistance can hold corporate power in check.

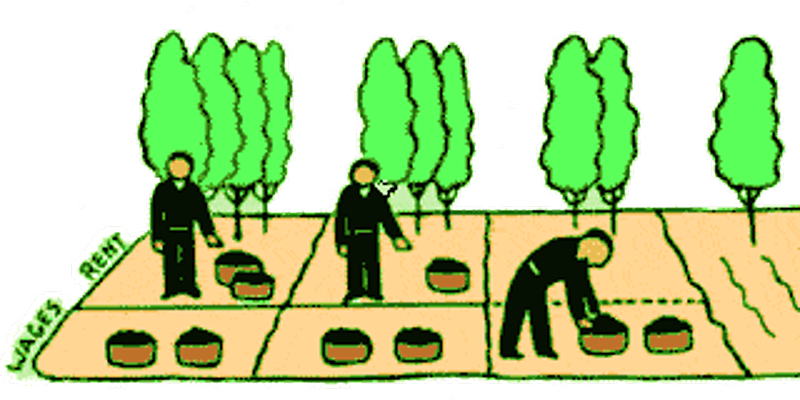

What happens when a multi-billion dollar transnational corporation faces organized resistance from residents in the city where it operates a major oil refinery? Richmond, California is a working class, lower income city, populated by majority people of color, and has been home to Chevron’s biggest refinery for over 100 years. For decades, the corporation used its ample financial resources to capture local government and regulatory agencies, allowing it to pollute surrounding neighborhoods while minimizing its tax payments. Marilyn Langlois will tell us how coordinated grassroots efforts by the Richmond Progressive Alliance and allied organizations have propelled people power in promoting health, fair taxation and democracy for their community. This will be followed by Joshua Vincent’s take on efforts by Chevron to undermine the movement for land value taxation in Philadelphia and what would have been needed to overcome them.

Speakers:

Marilyn Langlois is a member of TRANSCEND, an international network for peace through education, and guest editorialist for Transcend Media Service. She is also a community organizer and solidarity activist in Richmond, California.

Joshua Vincent joined the Center for the Study of Economics (CSE) as Associate Director in 1993 and has served as Executive Director since 1997. At CSE, he has worked as a consultant to over 75 municipalities, counties, NGOs, and national governments. He has testified as an expert witness on the impact of land taxation, from the municipal level up to state legislatures in Texas, Connecticut, Maryland, Indiana and Ohio. Since 2000, Vincent and CSE have conducted over 50 land tax impact studies for cities all over the US.

Discussant:

Alanna Hartzok is transpersonal psychotherapist and a Tax Shift Projects Admin, twice US Congressional Candidate (Democrat and Green Parties), and author of The Earth Belongs to Everyone (Radical Middle Book Award). She was instrumental in the passage of tax reform legislations in Pennsylvania and administers the International Union for Land Value Taxation.