Henry George School of Social Science Calendar

- 0101.March.Monday

Understanding the Boom Bust Cycle

Session 4Henry George School of Social Science149 East 38th Street, New York, NY 10016UNDERSTANDING THE BOOM BUST CYCLE

Why do recessions occur in capitalist economies on a recurrent basis? Is there a single explanatory cause?In this 5-session course on the Boom and Bust Cycle, emeritus professor of Economics Dr. Fred Foldvary investigates the link between real estate and economic downturns otherwise known as business cycles. The course will revisit Homer Hoyt’s pioneering work as well as the role of money and interest rates in causing land bubbles.

Session 1: Real estate and the business cycle

Session 2: Mason Gaffney on downturns

Session 3: Homer Hoyt and the cycle

Session 4: Money, interest, and the cycle

Session 5: American land bubbles

Instructor Bio:

Fred Foldvary is a retired professor of economics . He received his Ph.D. in Economics from George Mason University. Foldvary’s scholarly interests include public finance, real estate economics, and social ethics. Foldvary is known for his research and publications on land value taxation, community associations, and business cycles. His books include The Soul of Liberty, Public Goods and Private Communities, Dictionary of Free-Market Economics, and The Depression of 2008. Besides his articles, Fred Foldvary has written columns for www.progress.org and is one the few economists who predicted the 2007 – 2008 financial crisis.Dates: Mondays – 2/1, 2/8, 2/22, 3/1, 3/8

Time: 6:30PM to 8:00PM EST5 sessions

A zoom link will be provided via email before the start of the first session. - 0303.March.Wednesday

George’s Quest for a National Single Tax: The Land Value Income Tax (LVIT)

Session 3Henry George School of Social Science149 East 38th Street, New York, NY 10016GEORGE’S QUEST FOR A NATIONAL SINGLE TAX: The Land Value Income Tax (LVIT)

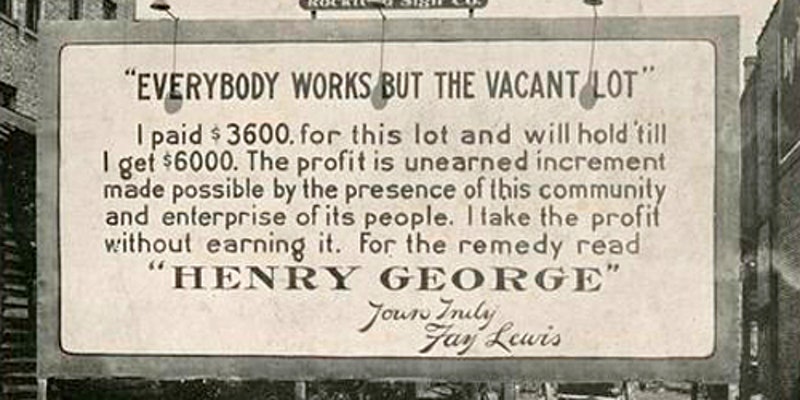

Join us for this new series of lectures on George’s quest for the “perfect tax.”In less than two years after Henry George first began publishing his weekly newspaper The Standard in January 1887, he begins recording a drive (in November 1888) to replace state-wide enforcement of the single tax with a uniform national single tax governed by Congress. This series of lectures and discussions chronicles that national drive from its inception, until after the 16th Amendment is ratified in 1913, which is when the national movement and the land value income tax (LVIT) should’ve resumed, after a major setback caused by the Supreme Court in 1895, but never did.

Session 1: Formation of the National Movement

Wednesday, February 17, 2021• National Enrollment Committee

• First National Single Tax Conference

• Platform of the Single Tax League of the United States

• Required Adoption of the Platform

Session 2: Shearman Proposes “A Just and Practicable Income Tax” to the 53th Congress

Wednesday, February 24, 2021• Final Months of The Standard

• Unauthorized Alteration of the 1890 Platform

• Ways and Means Subcommittee on Internal Revenue

• The LVIT is Law for 7 Months, Then Ruled Unconstitutional

Session 3: Shearman’s Temporary Return to the Statewide LVT Becomes Georgism’s Permanent Solution

Wednesday, March 3, 2021• Shearman’s Response to the Ruling in Pollock v. Farmers’ Loan (1895)

• A Fully Restored 1890 Platform Starts an Effort to Return to the National Campaign

• Louis Post and Joseph Fels Try to Restore the LVIT after Ratification of the 16th Amendment

• The Four Modern Land-Gain Income Taxes that Remain Relevant Today

The instructor: Richard DiMare is a graduate of Boston College and the Massachusetts School of Law, and has been a licensed Massachusetts attorney since 2006. He is interested in only one area of law, that which helps wage-earners, both white and blue-collar, to claim a property right in their wages, thus beginning the long-overdue process of shifting the tax burden away from wages and onto unearned incomes and large estates. Richard’s interest in this area of law likely developed from his background in the commercial fishing and seafood industries, witnessing many workers fighting for survival wages, then being taxed on those wages, while passive receivers of unearned incomes were increasingly under-taxed, or not taxed at all.

3 sessions

A zoom link will be provided via email before the start of the first session. - 0808.March.Monday

Understanding the Boom Bust Cycle

Session 5Henry George School of Social Science149 East 38th Street, New York, NY 10016UNDERSTANDING THE BOOM BUST CYCLE

Why do recessions occur in capitalist economies on a recurrent basis? Is there a single explanatory cause?In this 5-session course on the Boom and Bust Cycle, emeritus professor of Economics Dr. Fred Foldvary investigates the link between real estate and economic downturns otherwise known as business cycles. The course will revisit Homer Hoyt’s pioneering work as well as the role of money and interest rates in causing land bubbles.

Session 1: Real estate and the business cycle

Session 2: Mason Gaffney on downturns

Session 3: Homer Hoyt and the cycle

Session 4: Money, interest, and the cycle

Session 5: American land bubbles

Instructor Bio:

Fred Foldvary is a retired professor of economics . He received his Ph.D. in Economics from George Mason University. Foldvary’s scholarly interests include public finance, real estate economics, and social ethics. Foldvary is known for his research and publications on land value taxation, community associations, and business cycles. His books include The Soul of Liberty, Public Goods and Private Communities, Dictionary of Free-Market Economics, and The Depression of 2008. Besides his articles, Fred Foldvary has written columns for www.progress.org and is one the few economists who predicted the 2007 – 2008 financial crisis.Dates: Mondays – 2/1, 2/8, 2/22, 3/1, 3/8

Time: 6:30PM to 8:00PM EST5 sessions

A zoom link will be provided via email before the start of the first session. - 1010.March.Wednesday

Growth and Anarchy; legacy of Raworth and George

Session 1Henry George School of Social Science149 East 38th Street, New York, NY 10016Growth and Anarchy; legacy of Raworth and George

Join us for a series of enlightening lectures and discussions on the ramifications of the degrowth hypothesis.This five-class course explores the degrowth thesis of Kate Raworth’s Doughnut Economics -7 Ways to Think Like a 21st Century Economist (2017) and finds that Henry George actually supported a similar thesis, just 138 years earlier. The “Growth and Anarchy” title of the course is a play on George’s “Progress and Poverty” title. Anarchy is the likely outcome of pursuing growth (while accommodating its rent-seeking cousin) and failing to adopt a system of social development that has captured land values pay for those necessary services (that include breathable air, drinkable water, commonly-owned land, healthcare, security, transit, power, communications, and financial services) for the advantage of everyone.

Dates: Mondays – 3/10, 3/17, 3/24, 3/31, 4/7

Time: 6:30PM to 8:00PM EST5 sessions

A zoom link will be provided via email before the start of the first session. - 1111.March.Thursday

In Quest of a Multipolar World Order - Promises and Perils

SeminarHenry George School of Social Science149 East 38th Street, New York, NY 10016IN QUEST OF A MULTIPOLAR WORLD ORDER – PROMISES AND PERILS

Join us for another round of discussions on the new global power configuration and the prospects for peace and economic well-being.When an incumbent superpower is challenged by a rising new power, history shows that those are generally perilous times, and tensions are building up. Will the quest for peace prevail over the risk of further confrontation and conflict? In this second conversation, Michael Hudson and Pepe Escobar will examine the state of the world through a geopolitical and geo-economics lens. They will discuss the opportunities and threats as we transition from a unipolar world to a multi-polar system.

Michael Hudson is an American economist, Professor of Economics at the University of Missouri–Kansas City and a researcher at the Levy Economics Institute at Bard College, former Wall Street analyst, political consultant, commentator and journalist. Michael is the author of J is for Junk Economics (2017), Killing the Host (2015), The Bubble and Beyond (2012), Super-Imperialism: The Economic Strategy of American Empire (1968 & 2003), Trade, Development and Foreign Debt (1992 & 2009) and of The Myth of Aid (1971), amongst many others. His books have been translated into Japanese, Chinese, German, Spanish, and Russian.

Pepe Escobar, born in Brazil, is a correspondent/editor-at-large at Asia Times, and columnist for Consortium News (D.C.) and Strategic Culture (Moscow). He has extensively covered Pakistan, Afghanistan, Central Asia, China, Iran, Iraq and the wider Middle East. Pepe is the author of Globalistan: How the Globalized World is Dissolving into Liquid War (2007); Red Zone Blues: a Snapshot of Baghdad during the Surge. He was contributing editor to The Empire and the Crescent (Amal Books, Bristol). His last two books are Empire of Chaos (2014) and 2030 (2015). Pepe is also associated with the Paris-based European Academy of Geopolitics. When not on the road, he lives between Sao Paulo, Paris and Bangkok.

Date and time: Thursday, March 11

Time:, 9:00 AM – 10:30 AM EST (New York)

A link to join the online seminar will be provided via email before the start of the webinar.